FIRST QUARTER MUNICIPAL BONDS UPDATE

Market Recap

Market volatility tied to tariffs was the overriding theme driving rates during the first quarter. The Trump administration’s wide-ranging tariffs increased probabilities for a global recession, and, as a result, Treasury rates fell across the curve. During the quarter, 2- and 10-year Treasuries fell by 36 and 37 basis points (bps), respectively. After the administration’s ‘Liberation Day’ reciprocal tariffs were announced on April 2nd, Treasury rates in 10yrs fell by an additional 21bps to end the week at 4%1.

Credit Concerns are Developing

After the Trump administration’s activities and headlines related to tariffs and spending cuts, the municipal market felt the impacts of its agenda that resulted in a weakening bias in its relative valuation profile. We are also watching the developments related to the current administration’s Department of Government Efficiency (DOGE) related cuts in federal spending tied to research spending, and potential cuts to federal aid to states and local governments. Cuts to higher education in the form of a 15% cap on indirect research expenses and targeted cuts to institutions for not adhering to diversity or protest-related guidelines have already reverberated through the higher education sector in the form of wider spreads. Potential cuts to states in the form of reductions in appropriations for Medicaid as a potential source of ‘pay-for’ for the extension of the Tax Cut and jobs Act is also something that we are watching closely. Federal Medicaid funding makes up approximately 35% of state revenues and a drastic cut in this revenue source could generate budget imbalances. Additionally, the potential for tariff-war related negative impacts on the overall economy could also create dislocations in their fiscal condition. Although we believe that states, with budget stabilization funds at 14% of expenditures coming into the fiscal year, are at healthy levels to help absorb some of these potential fiscal challenges, we could see relative valuations come under pressure to weaken further. Within the higher education sector, the cuts in research funding and other targeted cuts are also creating challenges within that sector that have resulted in proactive cuts in spending, including announced hiring freezes and job cuts across institutions. We continue to monitor the situation and remain very selective across these sectors, and we’re retaining an up-in-quality bias across our investment targets2.

Relative Valuations have Weakened

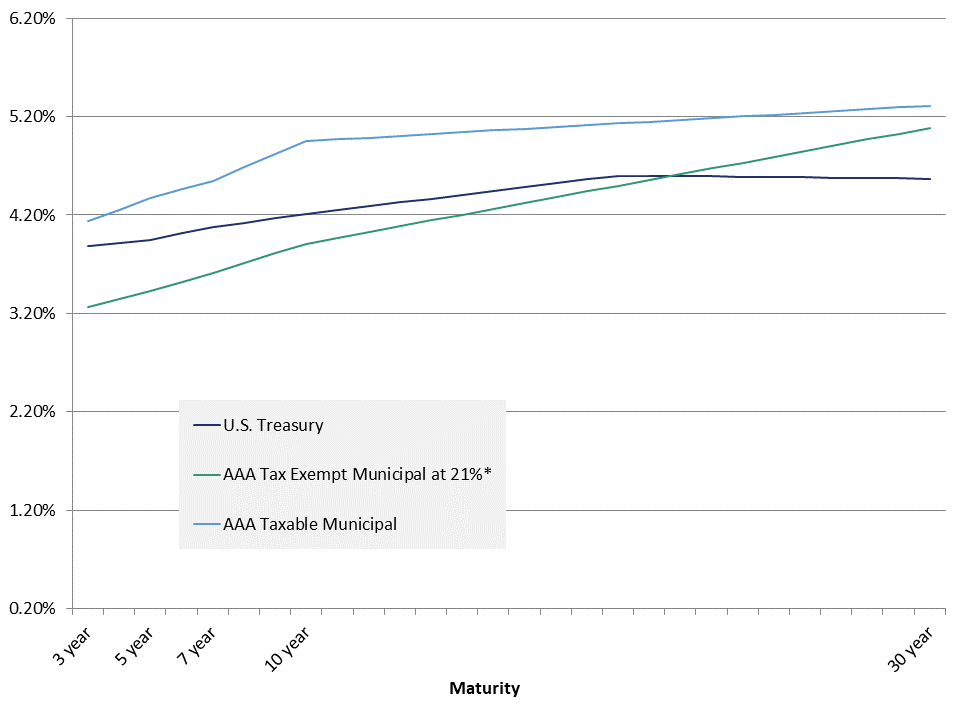

The ensuing volatility in rates during the quarter produced a substantial softening in relative valuations across the municipal market. The tax-exempt sector was already exhibiting a weakening bias prior to the rate volatility due to a softer technical cycle going into March. The combination of slower reinvestment flows and a surge in new issuance that’s currently outpacing 2024’s record levels by 14%, resulted in 10yr maturity tax-adjusted spreads to Treasuries (21% corporate rate) to widen by 48bps during March. For the quarter, this spread widened by 60bps to end the quarter at -30bps. Muni-to-Treasury ratios in 10yrs reached a 2-year high of 77.65% during March before ending the quarter at 77.5%. With new issue supply expected to remain elevated and trend to a second consecutive year of record levels, we believe relative valuations for the sector could continue to weaken further3.

Taxable Municipals are Attractive

The weakening in relative valuations also extended to the taxable muni sector. The headline risks tied to higher education funding cuts and the tariff-related concerns have been more acutely felt within the 10yr and longer area of the taxable muni yield curve. Spreads on names like 10yr Harvard University have widened from an offered-side of 35bps in mid -February, to trading wider by as much as ~33bps by the end of the first quarter. As of this writing, the ‘Liberation Day’ tariff announcement has generated more market volatility since quarter end and spreads have moved considerably wider. Spreads in maturities from 5yrs to 30yrs have been pressured wider by 22 to 36bps since mid-February, and we view this widening and current spread levels as a compelling entry point to add to the basis. However, for tax-exempts, although the sector has weakened substantially during the first quarter, the tax-adjusted spread levels for tax-exempt assets remain well-through taxable spreads, and we continue to call for a reduction in that sector via a sector rotation to taxable alternatives across the yield curve4.

Exhibit 1: Market Yields as of 3/31/2025

*Tax-exempt rates are tax-adjusted using a factor of 1.1996

1 Bloomberg, Bond Buyer

2 AAM, NASBO, Bond Buyer, BofA

3 AAM, Bloomberg, Refinitiv, Bond Buyer

4 AAM, Bloomberg

Utility Bill Inflation is Back: Balancing Growth, Reliability and Affordability in the AI Era

September 2, 2025