The turbulent first half of 2025 underscored why effective asset allocation is essential in Government Risk Pool investment portfolios. These portfolios support members and cover liabilities, so investment strategies must closely align with the pool’s risk profile and objectives. Following events such as President Trump’s liberation day tariff announcement in April, dramatic swings in Treasury rates and equities highlighted these risks. Had risk pools needed to meet cash needs during that turmoil, they may have been forced to sell investments at a loss. This paper will outline key asset allocation considerations for risk pools to focus on while determining their overall investment strategy.

Risk pools must consider several factors when determining their asset allocation. One element outside their control is state investment statutes; some states only allow investments in U.S. government, agency, and municipal bonds, limiting risk and potential returns. Where broader investment options exist, the risk/reward trade-offs can widen meaningfully. Two critical factors that should be focused on are the duration/liquidity profile of the fixed income portfolio and the allocation to risk assets.

The fixed income portfolio’s duration and liquidity should align with the pool’s liabilities and net position. In practice this requires working with the leadership of the pool to review historic cash flows and analyze actuarial reports and financial statements. Having an appropriate duration target and fixed income portfolio structured to reflect the pool’s liabilities and liquidity needs can help maximize income within appropriate risk limits and reduces the need to sell securities in times of market stress at potential losses. The importance of this practice was evident during the rising interest rate environment in 2022-23. Between rising interest rates, and a large increase in reinsurance costs for property and liability pools, this period highlighted the risk of having to sell bonds at a significant loss. Portfolios with duration aligned with liabilities limited this risk significantly.

Another key factor is how much of the portfolio is invested in risk assets, such as equities, high-yield bonds, bank loans, and convertible bonds. Risk assets can generate additional investment returns over investment-grade bonds but are more volatile. This additional return helps to grow net position over time. This potential for added return, combined with income optimization in the fixed income portfolio, can provide stabilization to member contributions. As with duration, the risk asset allocation should reflect the liabilities, liquidity, and financial position of the pool. If underwriting results shrink net position, reducing risk assets may be prudent. Risk pools often benefit from a structured asset allocation process that considers these factors. Industry practitioners have published various approaches to modeling these risks.

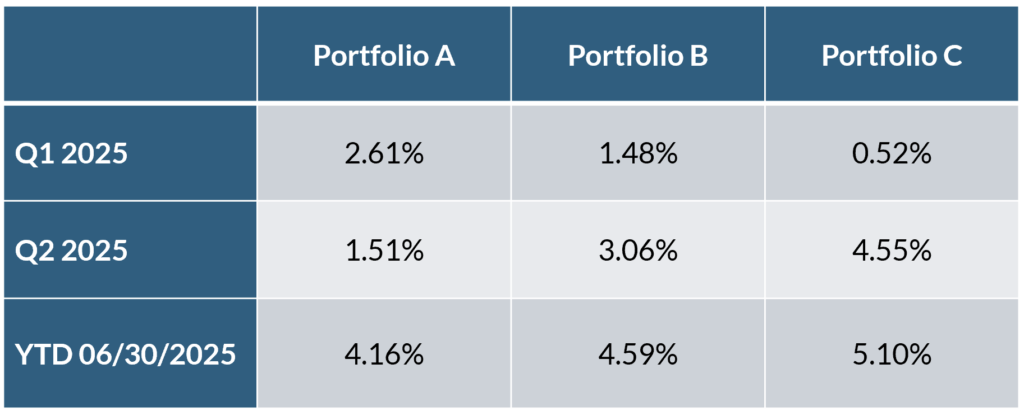

To illustrate the impact of allocations in the volatility of the first half of 2025, the table below shows simulated returns for three portfolios: A (0% risk assets), B (intermediate risk asset allocation), and C (more aggressive risk asset allocation).

You can see, looking at the quarterly returns for the first two quarters, that although Portfolio B and C have higher returns in 2025, the portfolios underperformed Portfolio A, which had 0% risk assets in the first quarter when risk assets underperformed. None of the portfolio allocations listed above are more correct than the others and the allocation should depend on the pool’s risk tolerance, underlying investment goals, underwriting environment, and financial position.

The duration of the fixed income portfolio and asset allocation of the investment portfolio are important components for maximizing the risk-adjusted return of a pool’s investment portfolio and can result in differing investment outcomes. Modeling that combines the capital position of a pool, with the profile of the liabilities, and the risk profile of investments can help pools achieve investment returns that support their members. This modeling can be complex and often requires close collaboration with key partners including your actuaries and investment managers.