The rise of private credit is frequently portrayed as a competitive threat to traditional banks—a zero-sum game between tightly regulated balance sheets and alternative lenders flush with institutional capital. Yet this framing misses the structural reality taking shape across today’s credit ecosystem. Rather than being displaced, banks have become deeply intertwined with private-credit platforms, supporting the liquidity, origination, and execution that enable these lenders to scale. At the same time, a growing subset of banks are rebuilding internal capabilities to originate, distribute, and selectively retain private-credit exposures themselves. As a result, cooperation and competition now coexist, and neither side operates on a separate track. Instead, banks and private lenders are increasingly meeting in the middle, where their interaction is defined by three primary channels:

1. Fueling the Engine: Banks as Liquidity Providers to Private Credit

Banks and private credit have a symbiotic relationship – private credit relies on bank funding to scale, while banks use private credit for capital-efficient lending growth.

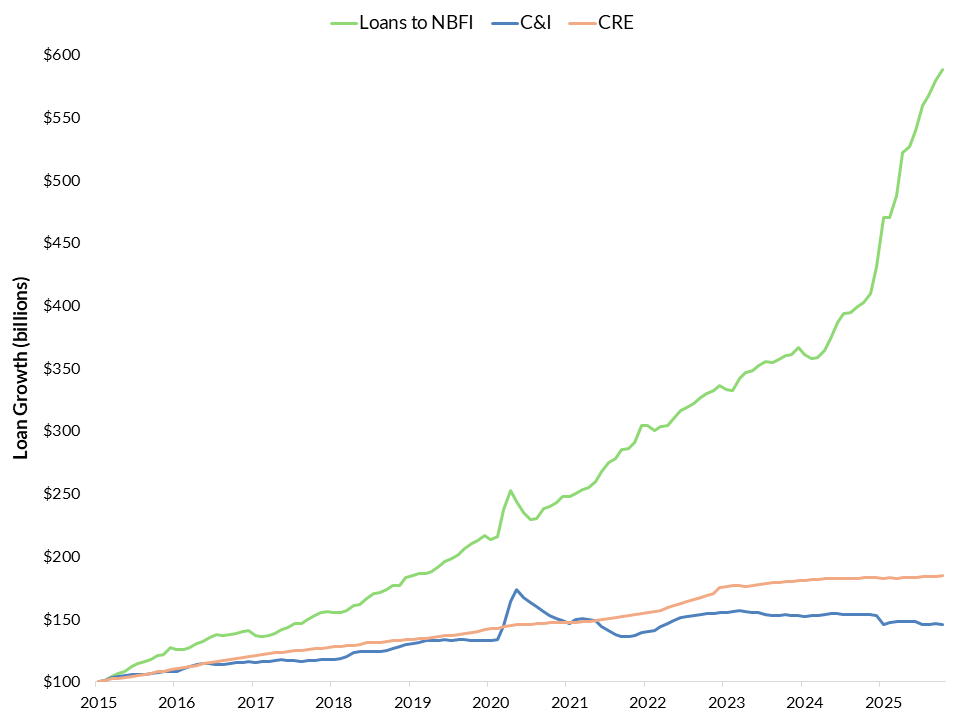

Banks have not been sidelined by the rise of private credit; instead, they have become a critical source of funding. Before private-credit funds can deploy capital into middle-market buyouts, sponsor roll-ups, or structured capital solutions, they must secure liquidity, which is overwhelmingly supplied by banks1. Through subscription lines, hybrid and net asset value facilities, revolving fund-finance lines, and warehouse credit, banks now provide the short-dated, collateralized borrowing capacity that enables private-credit managers to transact with speed, certainty, and leverage. This isn’t a marginal activity: bank lending to non-depository financial institutions (NDFI) has surged from $271 billion in 2015 to nearly $1.3 trillion as of October 20252, reflecting a strategic reorientation of lending activity toward capital-efficient exposures that offer attractive returns without the capital burdens of holding corporate loans directly (Exhibit 1)3.

Exhibit 1: Lending to NBFIs has become the fastest-growing commercial segment

Growth in commercial lons by category, 2015 to 2025* (US$ billions)

Source: AAM, Board of Governors of the Federal Reserve System (US).

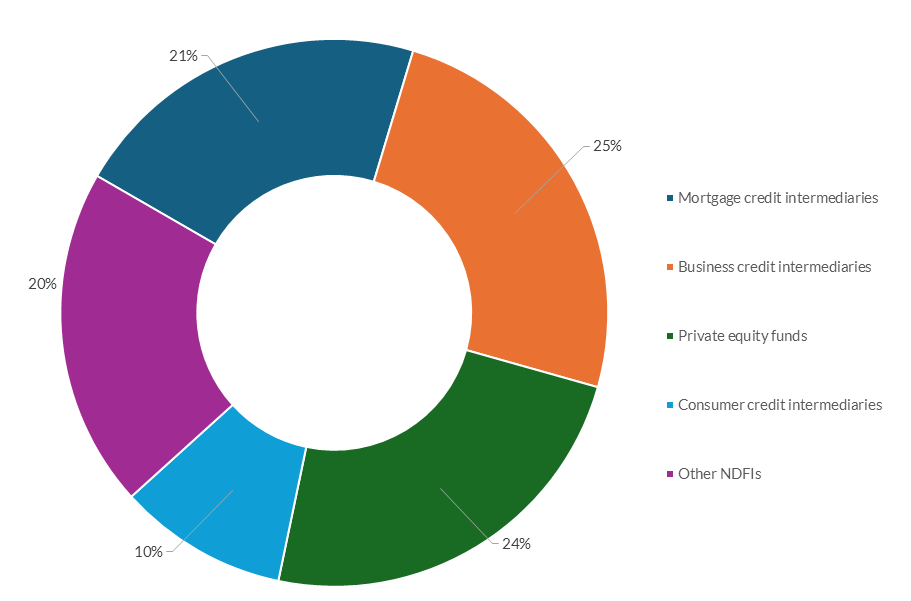

This lending pivot has effectively made banks the upstream liquidity providers to the private-credit ecosystem, which now originates much of the middle market LBO lending that banks once financed4. Aggregate call report data for U.S. commercial banks shows that roughly half of NDFI exposures are tied to business-credit intermediaries and private-equity funding vehicles (Exhibit 2)5, underscoring the central role banks have played in supporting the broader expansion of private capital. For private-credit funds, this financing delivers the operational velocity needed to win deals and scale portfolios; for banks, it unlocks capital-light lending and continued relevance in sponsor and corporate ecosystems. The result is a deeply symbiotic relationship: private credit cannot operate at its current pace without bank liquidity, and banks increasingly depend on private credit as a scalable, capital-efficient avenue for lending growth.

Exhibit 2: U.S. Bank loans to Nondepository Financial Institutions

By Intermediary Type, September 2025

2. Partnerships and Deal Sourcing: A New Collaborative Pipeline

Banks are extending beyond funding relationships by partnering in private credit through off-balance-sheet arrangements with alternative managers.

As the private-credit ecosystem matures, banks are expanding collaboration with alternative asset managers. Banks are no longer only funding sources. Through these partnerships, banks diversify revenue by earning fees from structuring and distributing credit products, monetize client flows by expanding lending solutions, and manage risk by sharing exposures with partners. This shift creates a new balance, allowing banks to broaden services without increasing balance-sheet risk. Private credit firms, in turn, access more deal flow and lending opportunities. The result is a more collaborative credit ecosystem, with a fluid boundary between competitors and counterparties. Among the most important developments are off-balance-sheet solutions that blend bank origination with third-party capital. Two recent examples from Wells Fargo and Citigroup highlight the range of emerging approaches.

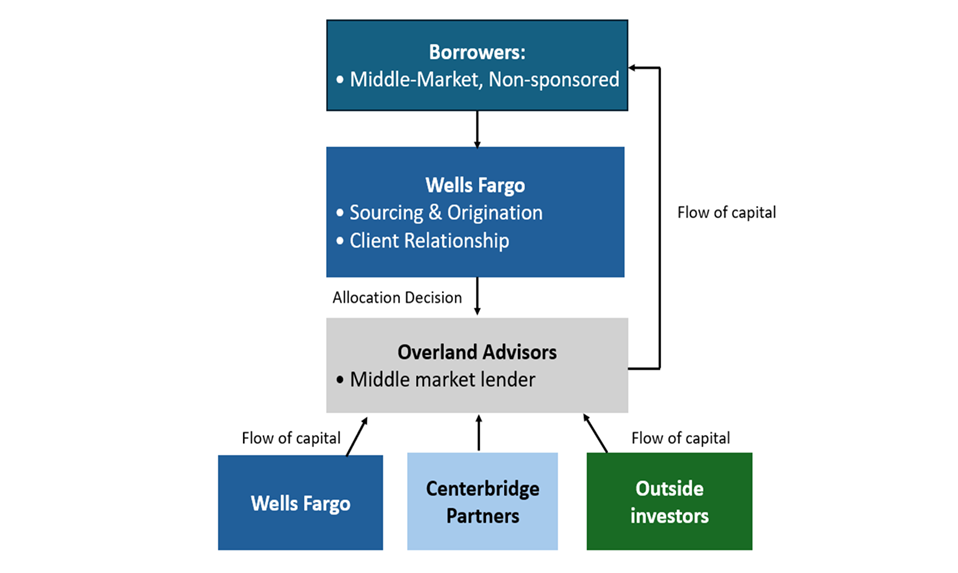

Wells Fargo: “Originate and Retain” through an Off-Balance-Sheet JV

Wells Fargo established an early blueprint with its September 2023 joint venture with Centerbridge Partners. The result is a $5 billion business development company (BDC), Overland Advantage, which targets senior-secured loans to middle-market borrowers. The venture channels origination through Wells Fargo’s commercial banking network, but exposures remain in an off-balance-sheet vehicle capitalized by Wells Fargo, Centerbridge, and other outside investors. Wells Fargo can selectively retain senior positions while also earning underwriting, servicing, and syndication fees with lower capital intensity. Centerbridge gains proprietary loan flow and scalable credit deployment. The partnership blends Wells Fargo’s sourcing and relationship infrastructure with Centerbridge’s private-credit expertise and capital base6.

Exhibit 3: Overview of Wells Fargo Originate-and-Retain Model via the Centerbridge Joint Venture

Source: AAM

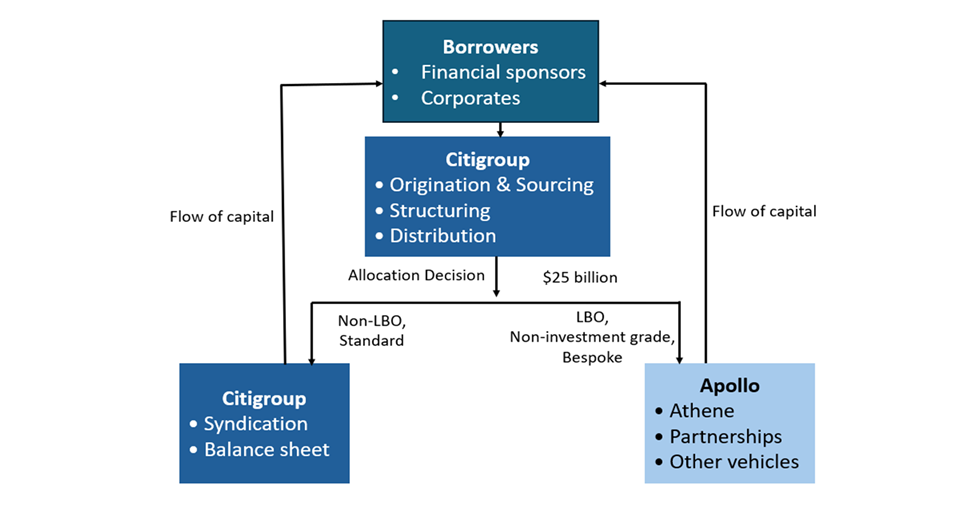

Citigroup: Originate-to-Share with Risk Transfer

Citigroup’s September 2024 partnership with Apollo Global Management extends the partnership model by emphasizing risk redistribution. The $25 billion arrangement focuses on corporate and sponsor-backed lending7 using an “originate-to-share” architecture focused on leveraged buyout (LBO), non-investment grade transactions. Citi sources and underwrites deals, then allocates the exposure to Apollo-managed vehicles and partnerships. The structure allows Citi to engage in private credit with the same depth and expertise as it has done with syndicated debt market without using its balance sheet. It broadens Citi’s client reach and fee-based revenue by offering clients more innovative and bespoke financing solutions8. In return, Apollo gains scaled access to institutional credit flow and greater opportunities to deploy its extensive capital base9.

Exhibit 4: Overview of Citigroup’s Originate-to-Share with Risk Transfer Model with Apollo

Source: AAM.

3. Business Models Shifts: Some Banks Remain at the Center of the Ecosystem

Some banks are moving beyond partnership models by rebuilding internal private-credit capabilities, using balance-sheet scale or platform-driven distribution to retain control over lending economics.

The partnership model reflects a growing interdependence between banks and private-credit managers, but collaboration is only one side of the story. Even as many banks outsource balance-sheet risk and co-invest with alternative lenders, others, most notably JPMorgan and Goldman Sachs, are moving in the opposite direction by rebuilding internal capabilities to originate, distribute, and retain private credit exposures themselves. Rather than operating solely as intermediaries or capital facilitators, these institutions are redesigning their business models to keep a greater share of lending economics within the firm. By leveraging advisory platforms, corporate-banking networks, asset- and wealth-management franchises, and targeted balance-sheet commitments, they are preserving control over sourcing, underwriting, and client relationships. In this next stage of evolution, banks are not just partners to private funds; firms like JPMorgan and Goldman Sachs are quietly becoming competitors again, using scale, distribution, and regulatory efficiency to stay at the center of the private-credit ecosystem.

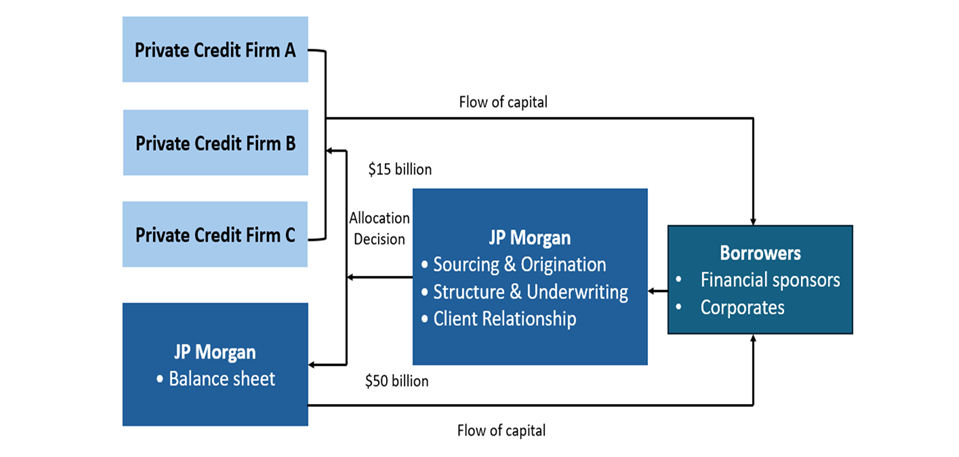

JPMorgan: Balance Sheet + Co-Investment as a Hybrid Lending Platform

JPMorgan is pursuing a balance-sheet-forward strategy designed to keep private credit origination inside the firm. In February 2025, the bank committed $50 billion of its own capital to direct lending and secured an additional $15 billion from third-party co-lenders10. Under this hybrid model, JPMorgan originates and underwrites loans, retains capital-efficient exposures, while allocating complementary tranches to external private-credit investors. The bank controls the sourcing, underwriting, and relationship economics, while still sharing risk and expanding lending capacity through partners. This approach allows JPMorgan to deliver customized financing solutions, without fully outsourcing deployment to outside capital11.

Exhibit 5: Overview of JPMorgan’s Hybrid Lending Platform

Source: AAM.

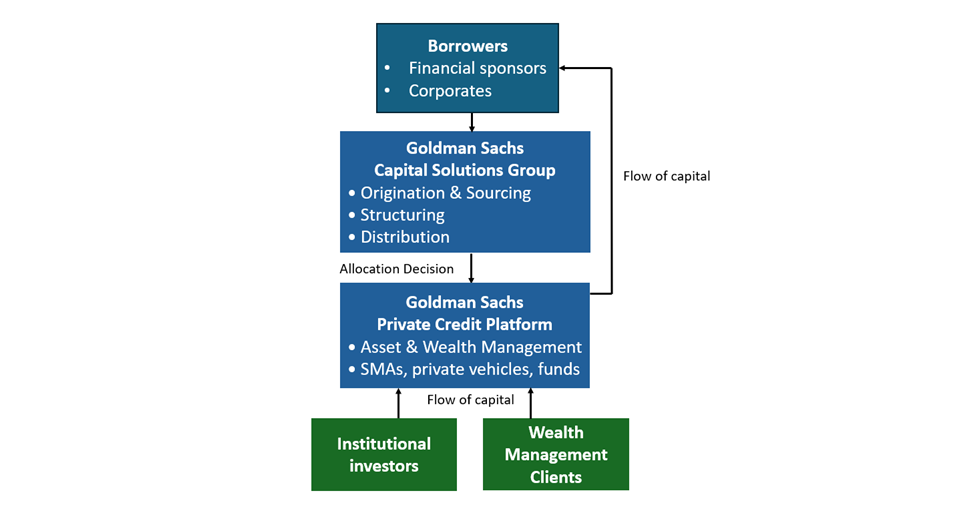

Goldman Sachs: Integrated Capital-Light Platform

Goldman Sachs employs a platform-driven model that channels private credit through asset- and wealth-management franchises rather than relying primarily on its balance sheet. In January 2025, the firm launched its Capital Solutions Group to integrate origination, structuring, and distribution of private capital across a single platform. The group sources sponsor- and corporate-financing opportunities and allocates them to third-party capital deployed through within Goldman’s managed investment offerings12. By linking investment-banking and markets deal flow with scalable internal client capital, Goldman can structure customized financing solutions and deploy them across senior, mezzanine, and hybrid credit strategies. The model monetizes advisory and underwriting flow while positioning private credit as a strategic growth driver for its asset-and wealth-management divisions. It also allows Goldman to compete with private-credit managers without retaining substantial balance-sheet risk13.

Exhibit 6: Overview of Goldman’s Integrated Capital-Light Platform

Source: AAM.

The evolution of private credit has not displaced banks; it has repositioned them. As private-credit markets have scaled, banks have adapted by supplying liquidity, structuring partnerships, and, in some cases, rebuilding internal lending capabilities to remain central to credit origination and distribution. What has emerged is a credit ecosystem defined less by competition and more by interdependence. Private-credit managers rely on banks for speed, leverage, and market access, while banks increasingly use private capital to extend reach without absorbing full balance-sheet risk.

1 In its October 2025 Global Stability Report, the IMF estimates that large banks account for 90% of all lending to NBFI’s.

2 Federal Reserve Bank of St. Louis. “Other Loans and Leases: All Other Loans and Leases: Loans to Nondepository Financial Institutions, Domestically Chartered Commercial Banks (LNFDCBM027NBOG).” Accessed December 5, 2025. FRED, Federal Reserve Bank of St. Louis.

3 Federal Reserve Bank of St. Louis, “Other Loans and Leases: All Other Loans and Leases: Loans to Nondepository Financial Institutions, Domestically Chartered Commercial Banks (LNFDCBM027SBOG),” FRED, accessed December 5, 2025; Federal Reserve Bank of St. Louis, “Commercial and Industrial Loans, Domestically Chartered Commercial Banks (CILDCBM027NBOG),” FRED; Federal Reserve Bank of St. Louis, “Real Estate Loans: Commercial Real Estate Loans, Domestically Chartered Commercial Banks (CREDCBM027NBOG),” FRED.

4 Loan Syndications & Trading Association (LSTA), 2024 Direct Lending Review: Volume Surges Amid Favorable Market Conditions, citing LSEG LPC data, accessed November 24, 2025.

5 Federal Financial Institutions Examination Council (FFIEC), Central Data Repository (CDR), Call Report Bulk Data Download (Schedule RC-C, Part I), accessed December 8, 2025.

6 Wells Fargo. “Centerbridge Partners and Wells Fargo Enter Strategic Relationship Focused on Direct Lending to Middle-Market Companies.” Press release, April 25, 2023.

7 Citigroup Inc., “Citi and Apollo Announce $25 Billion Private Credit, Direct Lending Program,” Press release, September 26, 2024.

8 Citigroup Inc., “Citi Third Quarter 2024 Earnings Call,” October 16, 2024 (transcript), pp. 2,7.

9 Apollo Global Management, Inc., Investor Day Corrected Transcript, October 1, 2024, 30.

10 JPMorgan Chase & Co., “JPMorgan Expands Direct Lending Platform with $50 Billion Commitment,” press release, February 24, 2025.

11 JPMorgan Chase & Co., 2025 Investor Day Transcript, remarks by Troy Rohrbaugh (May 19, 2025).

12 Goldman Sachs, “Goldman Sachs Announces Creation of Capital Solutions Group,” press release, January 13, 2025.

13 Goldman Sachs. Bernstein 41st Annual Strategic Decisions Conference Presentation Transcript, remarks by John E. Waldron, May 29, 2025. Transcript provided by Bloomberg LP, pp. 11-14.