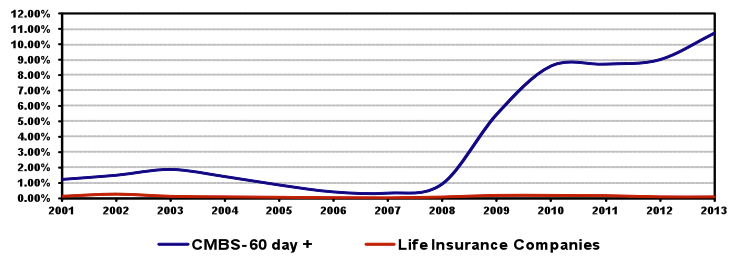

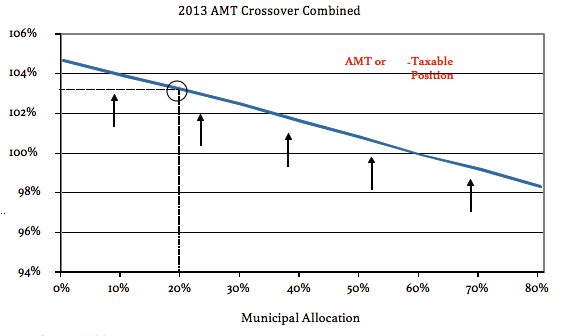

Within the investment grade fixed income market, there are four primary ways to enhance return: credit quality, liquidity, duration, or structure. All of these strategies introduce additional risk to the insurer’s balance sheet. We believe that there is one more lever for a taxable P&C insurer to pull, the crossover trade between taxable and tax-exempt securities. This trade does not involve adding incremental risk to the organization, rather it involves closely watching the spread relationship between taxable and tax-exempt securities, to exploit the opportunity as it presents itself.

Why an opportunistic strategy emphasizing average life, structure and liquidity is optimal.

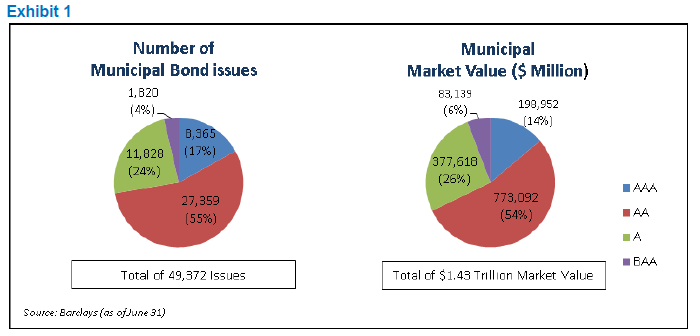

Let’s begin by stating the obvious – the tax exempt municipal bond sector is illiquid and concentrated in high quality issues. From Exhibit 1 below, there are 49,372 issues in the Barclays’ Municipal Bond Index with a market value of $1.43 trillion.

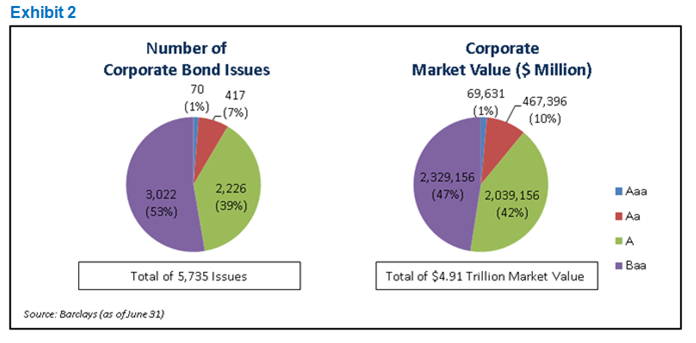

By comparison, there are 5,735 issues in the Barclays’ Corporate Index with a market value of $4.91 trillion as outlined in Exhibit 2. Thus, the Corporate Index has 11.6% of the number of issues and 3.4 times the market value of the Municipal Index.

Also note that the Barclays’ Municipal Index (by market value) contains 26% and 6% of ‘A’ and ‘BAA’ rated issues, respectively. By contrast, the Barclays’ Corporate Index contains 39% and 53% of ‘A’ and ‘BAA’ rated issues. To put the market value of the ‘A’ rated municipal bonds into perspective, it is slightly less than the market value of Exxon Mobil common stock.

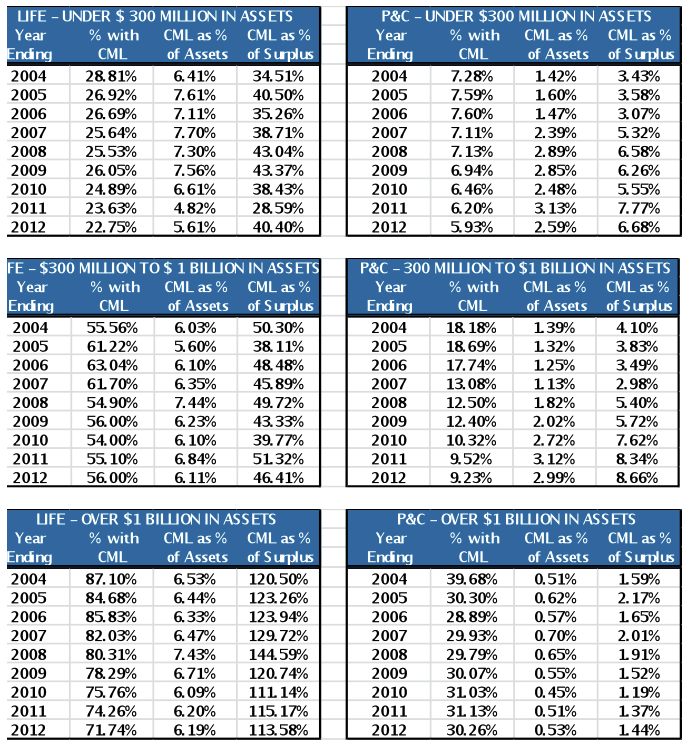

To summarize, constructing diversified municipal bond portfolios with a down-in-credit, yield-oriented focus involves investing in a small corner of an illiquid municipal bond market. The constraints of the investable municipal universe preclude any ability to scale across a large asset base.

A Scalable Alternative

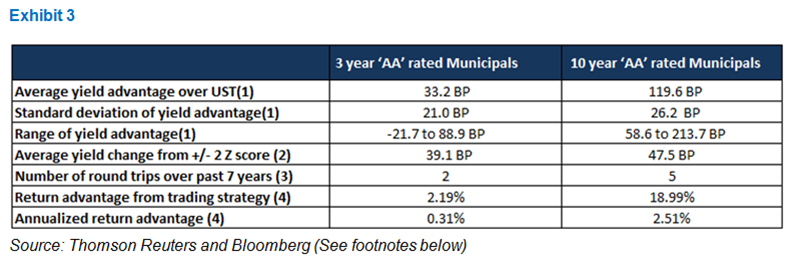

Taxable insurance companies seek to optimize after-tax yield and total return opportunities across the yield curve within the duration, quality and other constraints of their policy statement. As outlined in Exhibit 3 below, the relative attractiveness of tax exempt municipal bond yields (relative to comparable maturity Treasury issues) varies greatly across the yield curve. Using seven year weekly averages, the yield spread advantage (pre-tax equivalent yield for insurance companies) of ten year municipal bonds is 86 basis points greater than in three year bonds. In addition, the range of yield spreads is far greater in the ten year area.

At AAM, we track spread relationships and Z scores on a daily basis. A trading strategy that involves purchasing ten year tax exempt municipal bonds when spreads (versus Treasury notes) are at a Z score of +2.0 and selling at -2.0 produced five round-trip opportunities for purchase and sale over the past seven years. Because both the average yield change and duration are much greater for the ten year municipal bond in comparison with the three year issue, the total return opportunity from the trading strategy is greater in the ten year part of the yield curve and produces a return advantage of 18.99% over the seven year period (2.51% on an annualized basis). Please see Exhibit 3 and the footnotes below for details.

One additional comment should be made about three year municipal bond yields. With an average spread over a three year Treasury bond of only 33 BP (based on seven years of data), there are much higher yielding opportunities in the taxable bond market. Thus, short municipal bonds should be viewed as a source of funds for yield enhancement opportunities in other taxable bond sectors.

A high quality approach leads to a stable credit profile

As of July 15, 2016 per Thomson Reuters, the average yield spread between ‘A’ and ‘AA’ rated tax exempt ten year municipal bonds is 29 basis points (114 basis points over the yield of a ten year U.S. Treasury bond). This yield differential is at the very narrow end of the range over the past 7 years and was as much as 106 basis points in July 2009. A comparison of the 29 basis point yield advantage of ‘A’ rated issues (which will more likely be part of a buy and hold strategy due to the illiquidity of ‘A’ rated bonds) with the annualized total return from the trading strategy of 2.51% annually highlights why an opportunistic trading strategy is superior.

At AAM, we believe it is critically important to analyze relative value at each and every point along the yield curve.

An opportunistic trading strategy requires investing in liquid bonds, which generally leads to high quality credits. Maintaining liquidity in municipal portfolios also requires a focus on coupon to avoid the negative tax consequences from a municipal bond trading at a discount price. Lastly, liquidity and tradability are enhanced by avoiding certain call structures.

To be clear, there are select ‘A’ rated issuers that offer value. But in our view, the opportunistic trading strategy that we have outlined is a better and more sustainable investment framework for managing taxable insurance company portfolios.

An important consideration is that the ability to trade fixed income securities is challenged in today’s market. This is especially the case for tax exempt municipal bonds. Investors looking to employ an opportunistic trading strategy must be large enough to fully participate in the primary market. Conversely, investors must be small enough to meaningfully execute purchase and sale programs within the narrow time windows when these opportunities are available. Due to these constraints, large municipal bond managers will likely have difficulty employing an opportunistic strategy.

We’ve discussed relative trading opportunities in tax exempt municipals, but it is important to point out that

Characteristics of An Opportunistic Trading Strategy

1. Focus on liquidity: Liquidity allows for the portfolio to be repositioned without significant transaction costs.

2. Focus on 10 year durations: The ten year part of the yield curve provides the better total return opportunity.

3. Focus on high quality credits: An opportunistic trading strategy requires investing in liquid bonds, generally leading to high quality credits.

insurance companies have other reasons to sell tax exempt bonds. With all credits, avoiding downgrades and impairment are critical factors for successful investing.

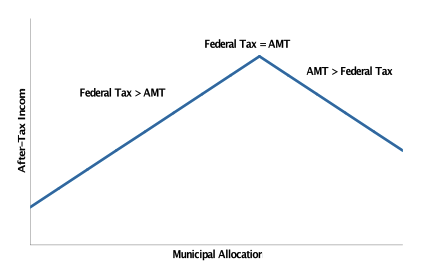

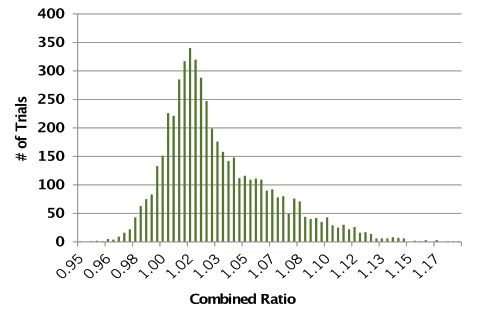

A high quality approach leads to a stable credit profile. This is very important in the municipal market as the availability of financial information is generally on an annual basis with a lag. In addition, the ability to fully benefit from the tax exemption of municipal income depends on underwriting profitability, which is subject to change based on each company’s underwriting experience. Maintaining a highly liquid municipal portfolio enables a company to reposition its portfolio without significant transaction costs (bid-offer spreads) when its tax situation changes.

Footnotes

The calculations are based on weekly yields from Thomson Reuters and Bloomberg over the seven year period ending July 15, 2016 using a 1.4577 tax adjustment factor on municipal yields to reflect the pre-tax equivalent yield of municipal bonds for insurance companies. This pre-tax equivalent yield on a ten year municipal bond is compared to comparable maturity Treasury yields to determine the yield spread. The standard deviation and range are also calculated from this relationship.

The Z score is calculated on a one year trailing basis using the pre-tax equivalent yield spread relationships outlined in (1) above.

The number of ‘round trips of going from -2.0 to +2.0 Z scores over this period and vice versa. This captures the number of round trip trading opportunities at extreme valuations.

The pre-tax return advantage from relative bond price movements versus comparable maturity Treasury notes over a seven year period is calculated by taking the nominal yield movements from purchases and sales when the municipal bond yield Z score is +2.0 and -2.0, respectively and calculating a price move based on the duration of three and ten year municipal bonds. The cumulative seven year number is annualized.

Written by:

Gregory Bell, CFA

Director of Municipal Bonds, Principal

John Schaefer, CFA

President, Principal

Additional Contributor:

Daniel Nagode