Market summary and outlook

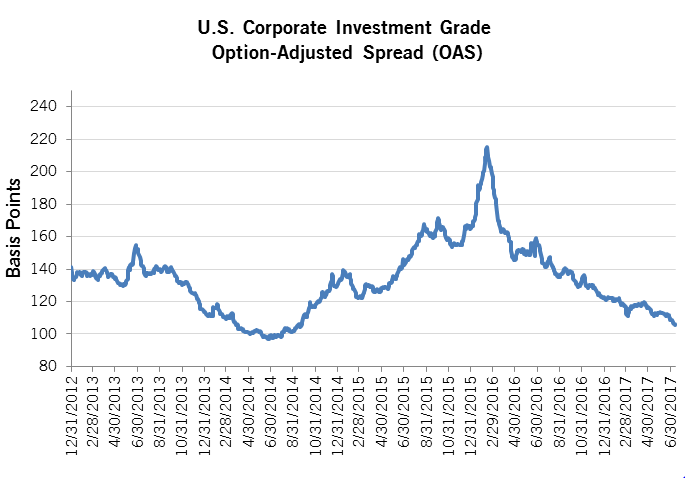

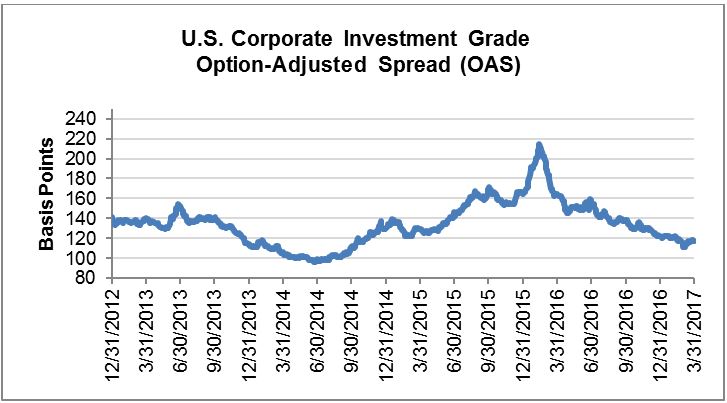

The Investment Grade (IG) Corporate bond market delivered a 3% total return in the second quarter 2017, with spreads tightening 9 basis points (bps). Risk assets performed similarly, as the S&P Index returned 3% in the second quarter, high yield 2%, and Emerging Markets 2% as well. Corporate bonds with maturities greater than 10 years outperformed shorter dated securities, contributing more than two-thirds of the total return performance of the IG Index per Bloomberg Barclays. Similarly, BBB rated securities outperformed and drove more than 50% of the performance.

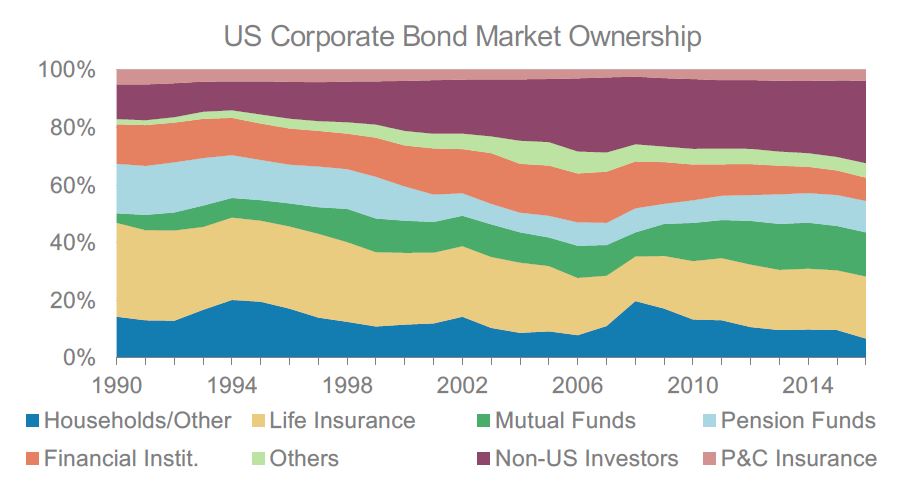

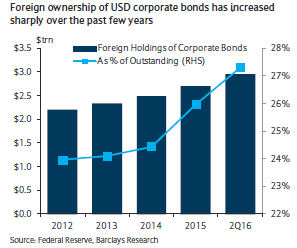

We continue to see strong demand from bond funds for investment grade securities, and foreign buying of USD IG debt remains a source of demand despite the less attractive yield advantage (net of hedging costs). New issue supply normalized in the second quarter, and the relatively light new issuance in longer dated maturities was one contributor to the outperformance of long corporate bonds. The unwind of QE may be a headwind for spreads in the intermediate term, but the market has digested the information constructively thus far.

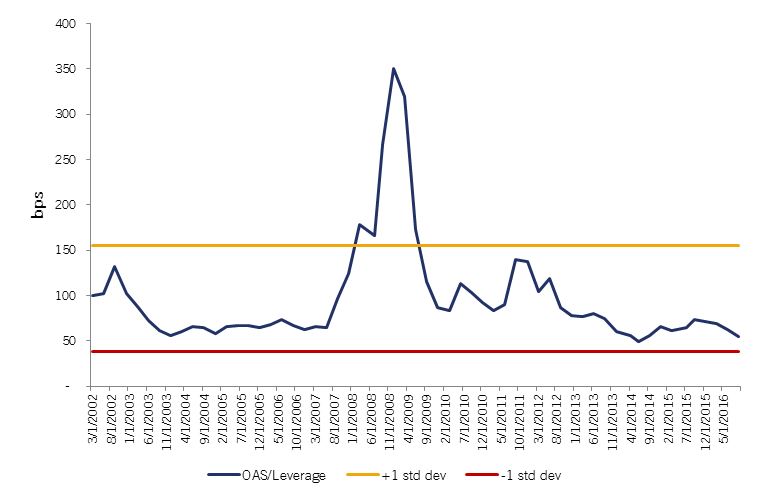

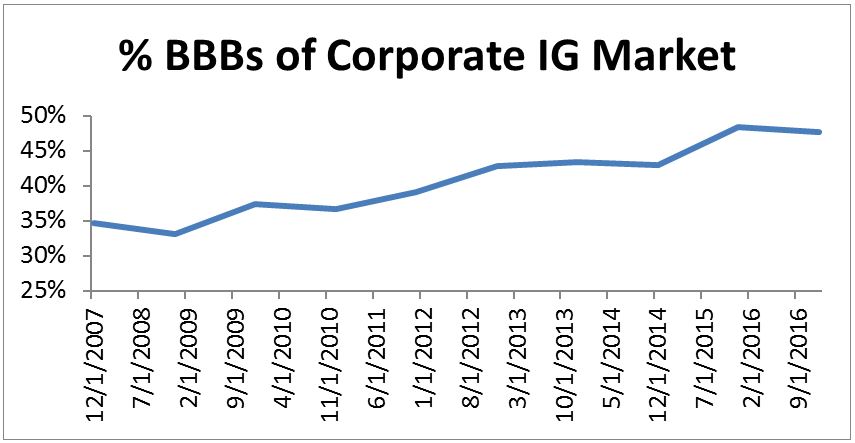

We expect returns to be generated largely from income over the near term, as the potential for spread tightening remains limited unless growth surprises to the upside and/or companies begin to meaningfully reduce debt. Despite lackluster valuations, we have a neutral opinion on the IG corporate sector, expecting technicals to remain supportive and fundamentals relatively stable over the near term given policy related uncertainty, improving overseas growth, and favorable lending conditions. Margin pressures such as rising labor costs and/or disappointing growth remain a risk given the elevated level of debt leverage and size of the credit market, BBB rated securities specifically. Tactically, we are maintaining flexibility to add on spread widening related to the unwind of central bank quantitative easing (QE).

Source: Bloomberg Barclays, AAM

Performance summary year-to-date

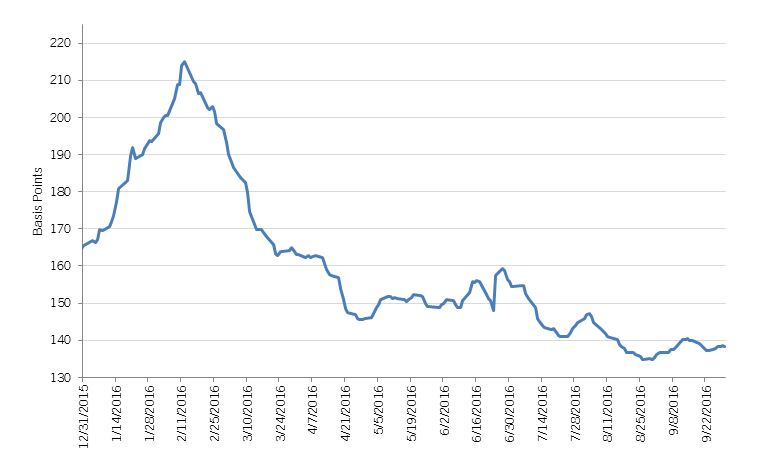

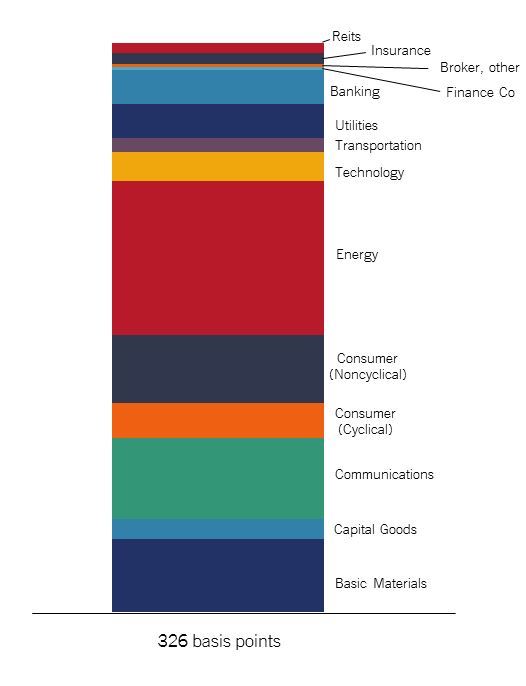

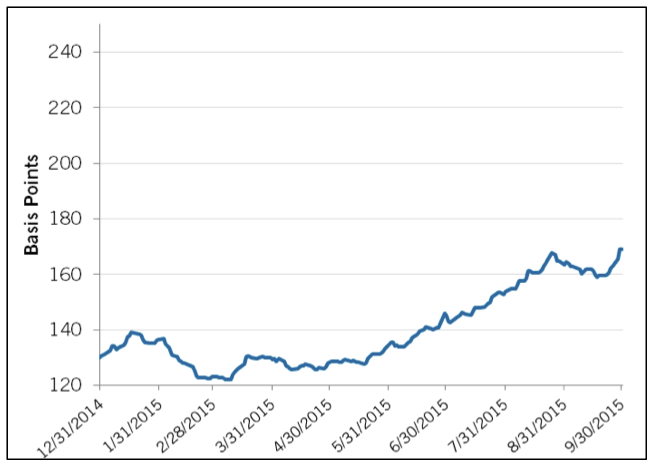

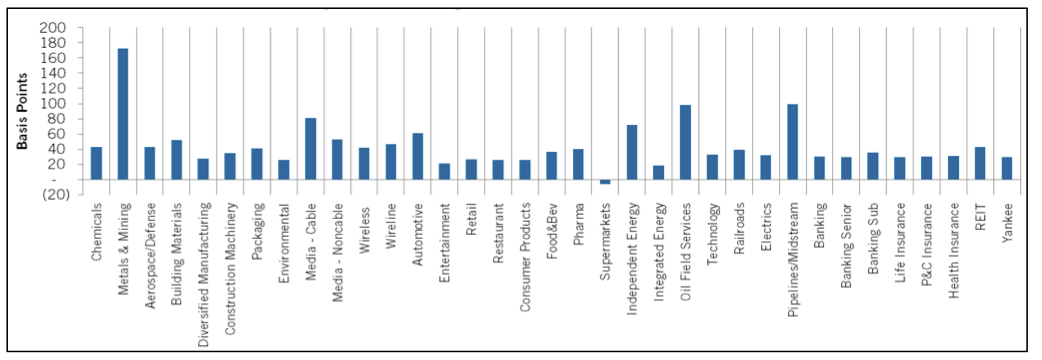

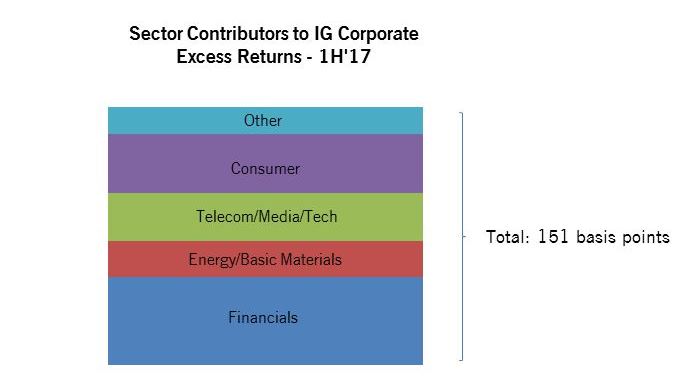

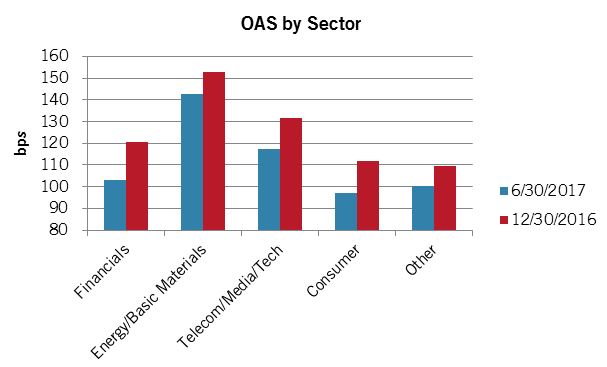

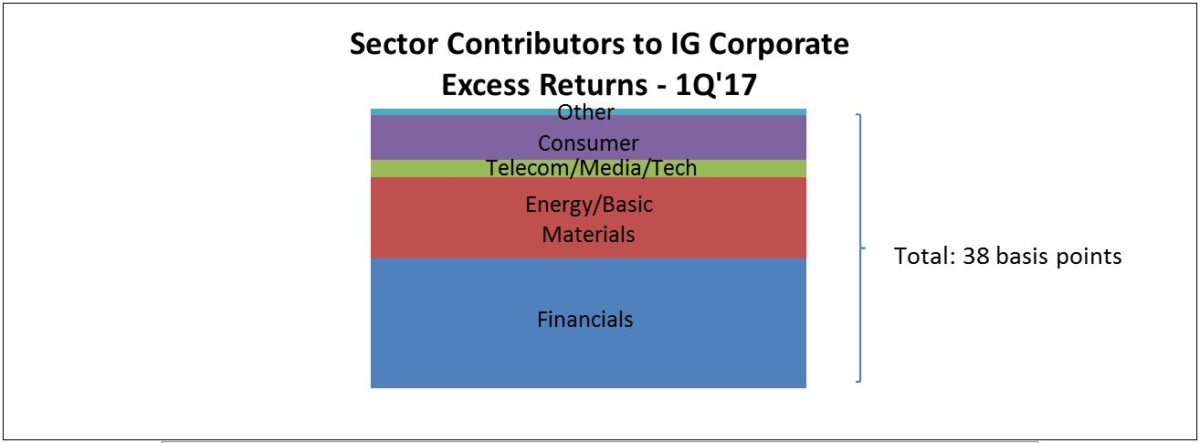

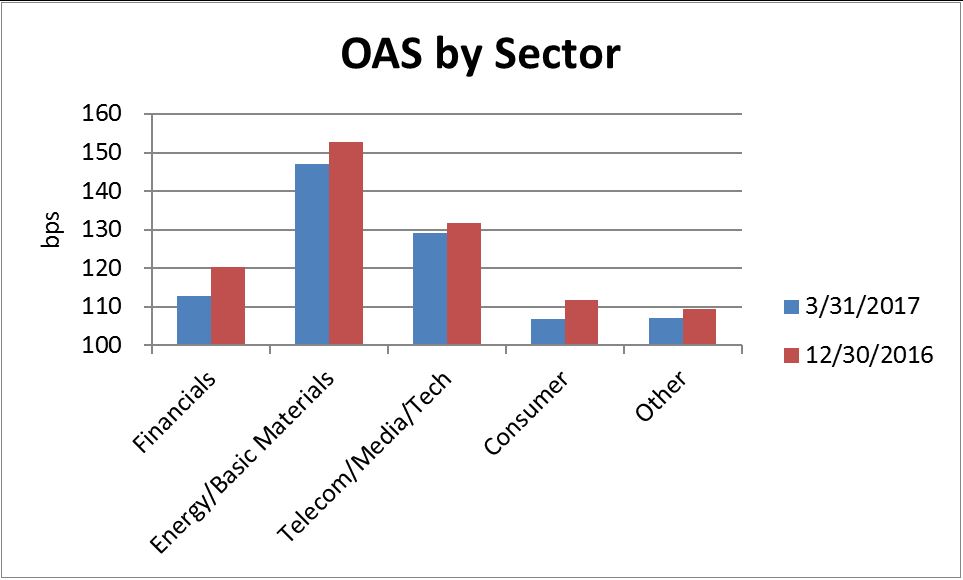

Spreads continued to tighten in the second quarter, with OAS 14 bps tighter year-to-date. Energy spreads underperformed in the second quarter due to the heightened volatility of oil prices. Year-to-date, every corporate sector has generated positive returns, with the Basic Materials and Finance sectors outperforming.

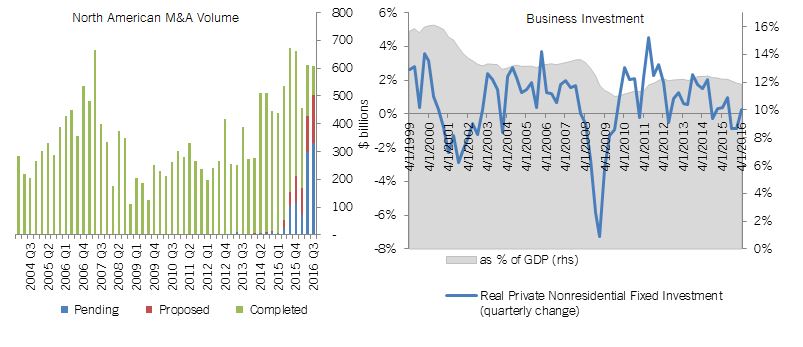

Rating actions have been positive with more than two times the number of “rising stars” (bonds moving from High Yield to Investment Grade) vs. “fallen angels” (from IG to HY). Improving fundamentals was the driver of 78% of the upgrades, with M&A being a smaller contributor. The same held true for the downgrades. M&A activity has remained active this year for larger deals. M&A related leverage loan volumes were down in the first half. LBO related activity has stalled due to high valuations and the limitation on leverage by the Federal government, although more leverage is being used to fund deals this year vs. prior years. Net demand for leveraged loans has been strong, resulting in weak covenant protection. We continue to monitor loan market fundamentals for signs of stress.

Source: Bloomberg Barclays Index (as of 6/30/2017), AAM

Credit fundamentals

Credit metrics remained fairly stable in the first quarter of 2017. We expect continued revenue and EBITDA growth in the second quarter, although it’s likely to moderate vs. the first quarter. Sectors expected to drive growth include Technology, Materials, and Energy with Telecom expected to be a drag. While it is early in the financial reporting season, we are pleased at the rate of loan growth for large, diversified banks given the weakness witnessed in the first quarter. Moreover, small business lending conditions as reported in the Credit Managers Index have improved, and the high yield and leverage loan markets remain accommodative. That said, we are not seeing signs of a break-out in growth that would cause U.S. GDP forecasts to be revised materially higher.

Policy uncertainty remains high, with tax reform unlikely in 2017. Sectors that were expected to benefit from firms repatriating cash from overseas have continued to access the debt market to fund acquisitions and debt maturities. A survey by Bank of America (Shin, John; “2017 Risk Management Survey” 7/10/2017) asked companies how they plan to use repatriated earnings, and of those that expect to benefit, 65% would use earnings to reduce debt as well as other uses such as share repurchases (46%), M&A (42%) and capital expenditures (35%).

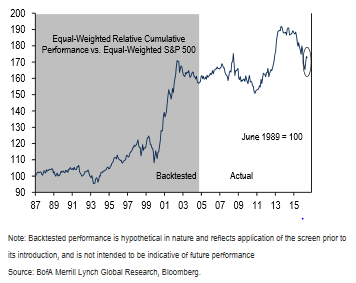

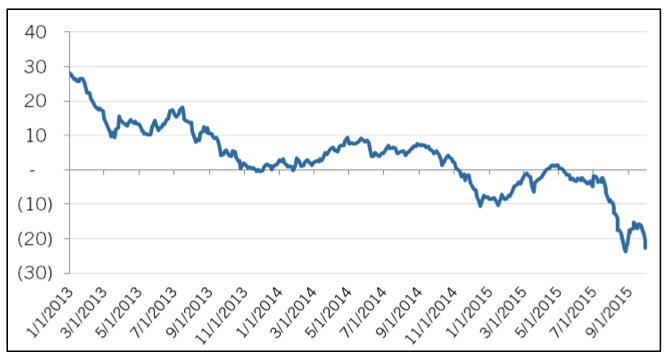

Interestingly, the companies that have been the most aggressive buyers of their common stock have seen their stocks lag in performance relative to the broad market (S&P 500). Since the financial crisis, this has not occurred on an annual basis except in 2014. We view that constructively from a credit perspective since firms have been using debt to fund share repurchase programs.

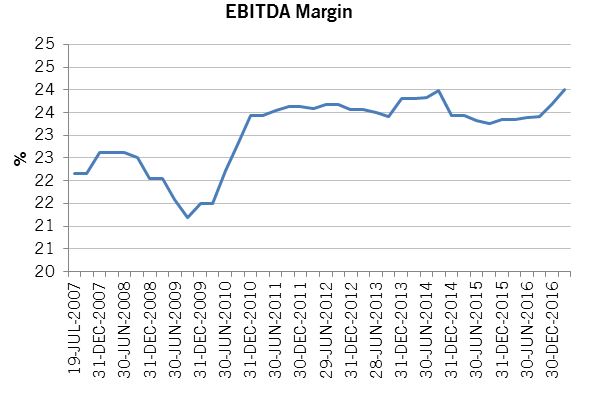

Margins remain historically high for many sectors, with management increasingly communicating labor cost related pressures. This remains a concern of ours especially as we saw the JOLTS Quits rate for the private sector increase to a level not seen since 2006. This has been a reliable indicator in the past for predicting increasing labor costs. Sectors like Consumer Discretionary and Healthcare are particularly exposed to rising labor costs. We have been very selective within these sectors, monitoring ROE and projected revenue growth. Sectors that are more immune to rising wages include Energy, Technology, and Insurance.

Source: Factset, AAM as of 3/31/2017 (Data excludes Energy, Metals/Mining, Financials, Utilities)

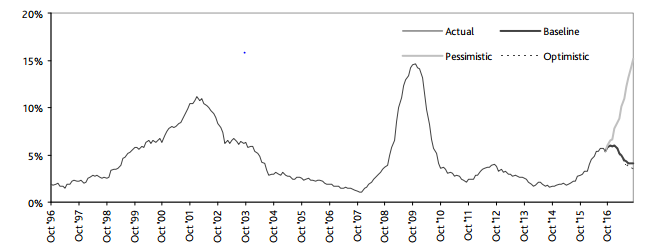

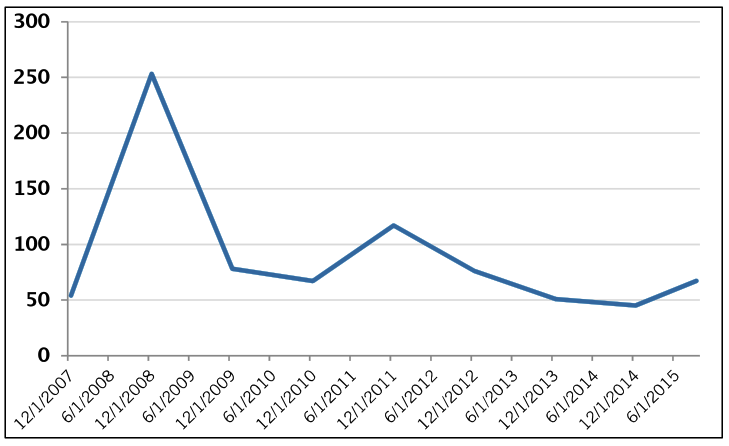

QE unwind

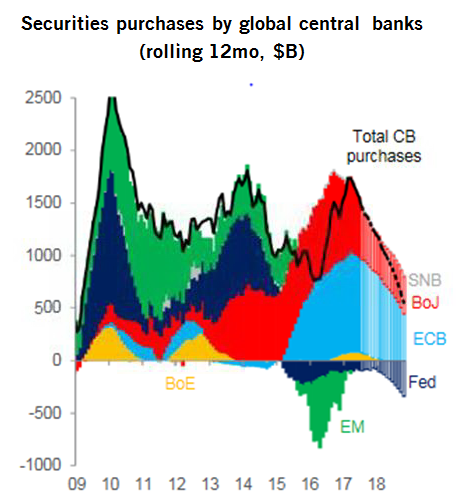

This Fall, the market expects the ECB to announce plans to taper its bond buying program and the Fed to announce that it has begun to shrink its balance sheet. If bond buying is reduced by half, what will happen to the demand for IG fixed income? While there has been a correlation between central bank purchases and the direction of US IG credit spreads, the cause of this relationship is less certain.

Since the financial crisis, there has been less net spread product issued due mainly to the contraction in the Structured Product and Muni markets. If we see MBS spread widening related to the unwind, it could put pressure on the Corporate market. However, we believe spread widening risk is higher for MBS since the net supply related to the unwind would be material as a percentage of the total MBS net supply expected in 2017 (>50%) vs. a much larger net supply of IG Corporates (<20%)** (footnote JPM Eric Beinstein June 2017; US High Grade Credit Market Trends and Outlook)

We acknowledge this technical risk, and given lackluster valuations, maintain flexibility to add on spread widening.

Source: National central banks, Citi Research, EMFX reserve changes are FX-adjusted

Written by:

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Source: Bloomberg Barclays, AAM

Source: Bloomberg Barclays, AAM

Source: Bloomberg Barclays Index (as of 3/31/2017), AAM

Source: Bloomberg Barclays Index (as of 3/31/2017), AAM  Source: Bloomberg Barclays (based on market values); AAM

Source: Bloomberg Barclays (based on market values); AAM