Key Points:

- Profitability continues while premium growth is slowing

- Investments yield levels appear to have found a bottom and are creeping higher

- Equity exposures are at pre-financial crisis levels and should be examined

- The industry faces pressure from cyber-security and the growth of the sharing economy that will challenge innovation in 2017 and beyond

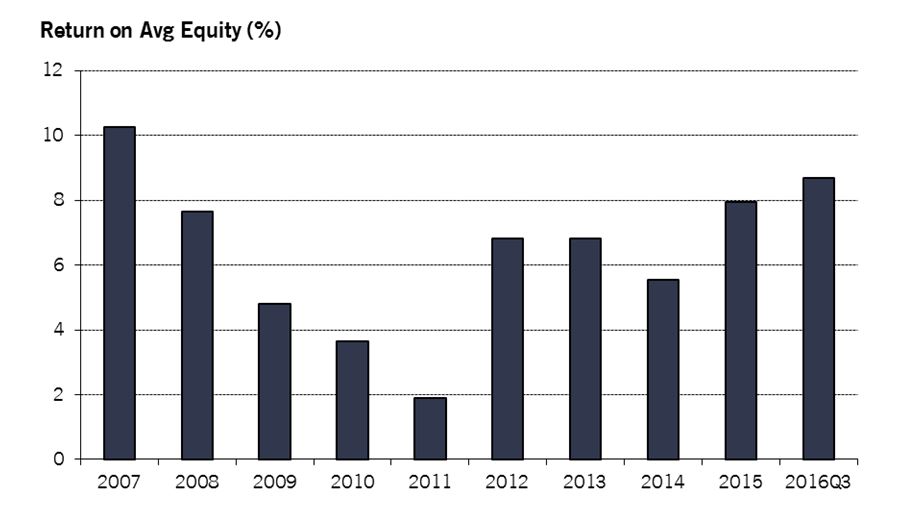

AAM’s Aggregate of Commercial Multiple Peril (CMP) insurers posted strong underwriting performance through the last twelve months (LTM) ended 9/30/16, posting a second year of profitability closely in line with the results of calendar year 2015. Net Premium Written (NPW) volume grew, but at a significantly reduced rate compared to recent years. Meanwhile underwriting leverage fell modestly, though remained well within the recent historical range. On the investment side the decline in investment yields seems to have finally bottomed out, with the unfortunate implication that portfolios have been fully turned over into the low prevailing rates of recent years. Exposure to common stock investments remains at elevated levels (measured as a % of surplus), posting at the highest level since 2007. In this report we will review these and other key financial results in the US Commercial Multiple Peril market, and look ahead to important developments in the coming year.

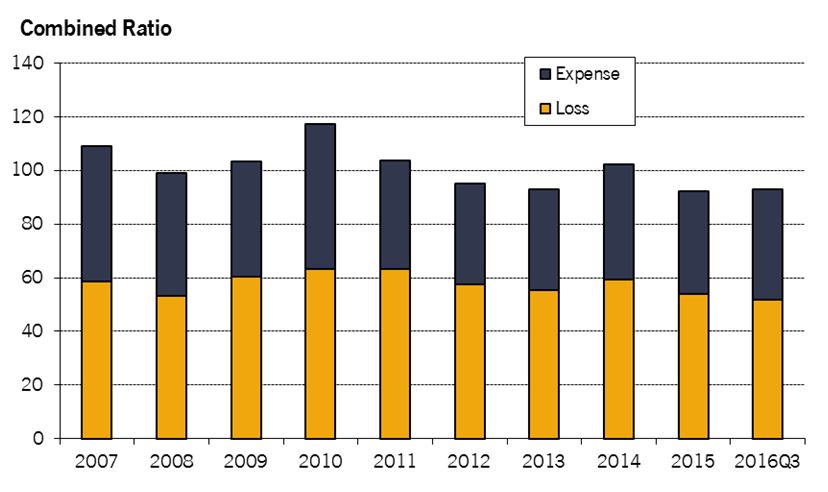

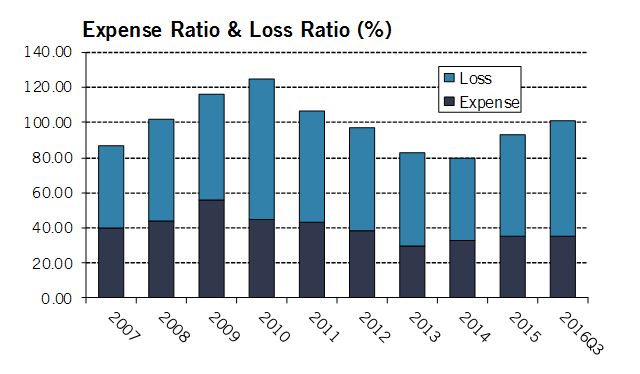

The CMP industry’s average loss ratio for the LTM period declined slightly to 51.9 versus 53.9 in 2015. Meanwhile expenses rose modestly to 41.1 from 38.3 (all income statement items in this report are on an LTM basis). This continues the trend of notable underwriting stability in the CMP market in recent years, with the modestly increased losses of 2014 attributable to a small number of companies in AAM’s aggregate experiencing outlier results. The trend of gradual but steady declines in underwriting expenses attributable to improved technology and operating efficiencies remains intact: for illustration, the average expense ratio from 2007-2009 was 46.5, versus 40.8 for the 3 most recent periods. Meanwhile the average premium retention ratio rose to 71 from 69, well within the normal historical range. Underwriting leverage fell from 73.1 to 70.2, as premium growth slowed relative to surplus.

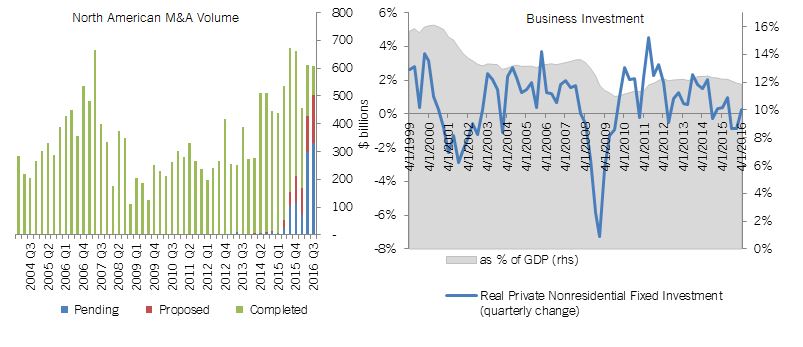

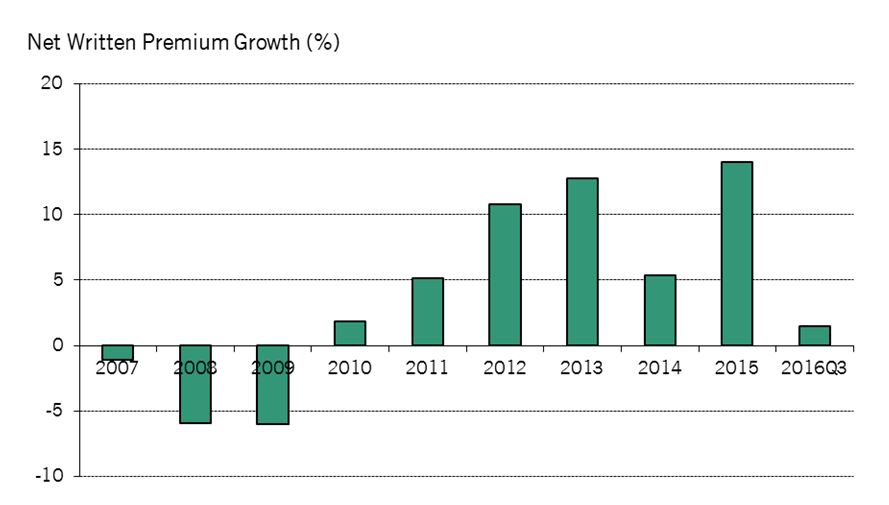

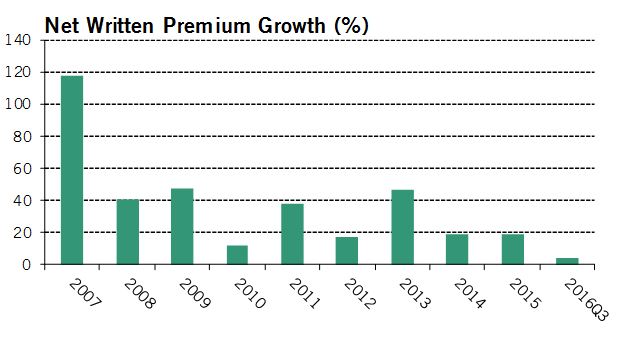

Specifically, CMP net premiums grew by only 1.5% through Q3 2016, after posting double-digit gains for 3 of the past 4 years. The primary reasons for this slowing growth appear to be a slower pace of small business formation (the NFIB’s Small Business Optimism index has been in decline since peaking in late 2014), and increased competitiveness leading to pressure on rates. As a result, the CMP industry’s total share of P&C industry premiums declined modestly from 7.1% in 2014 to 6.4% through Q3 2016.

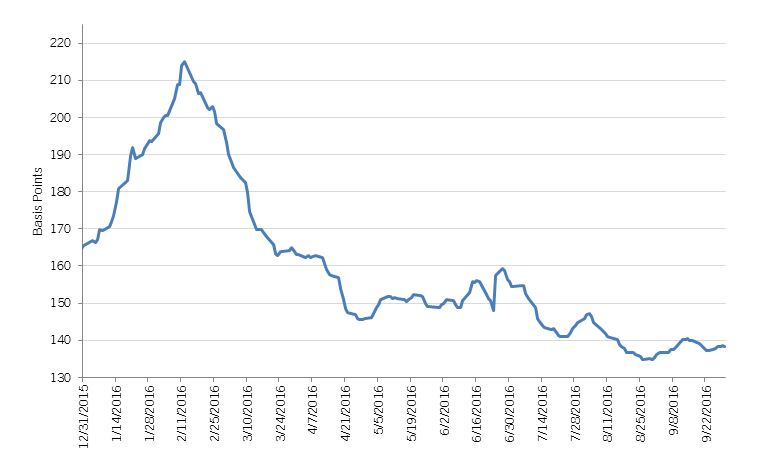

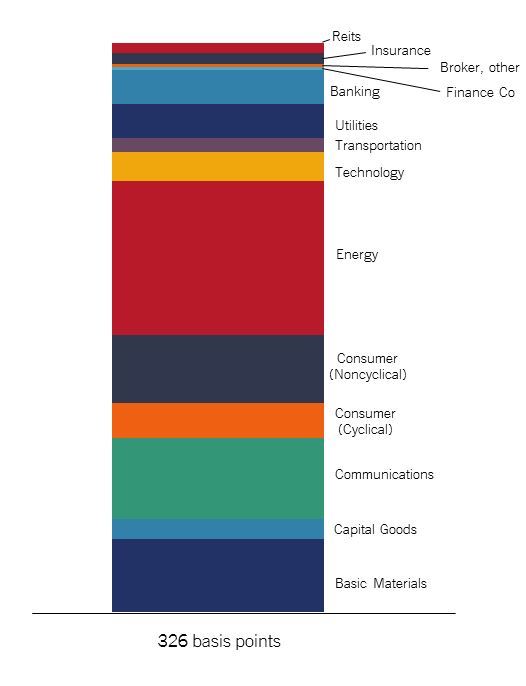

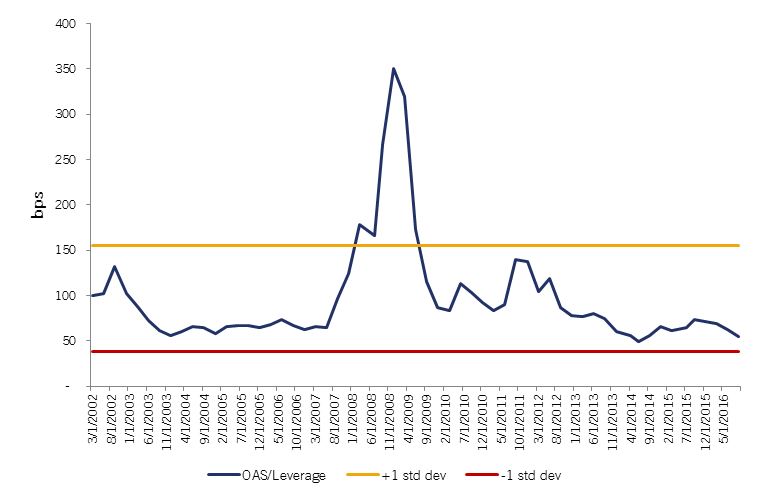

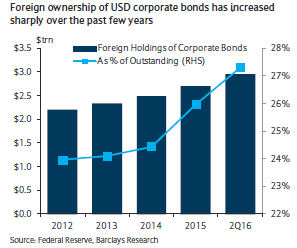

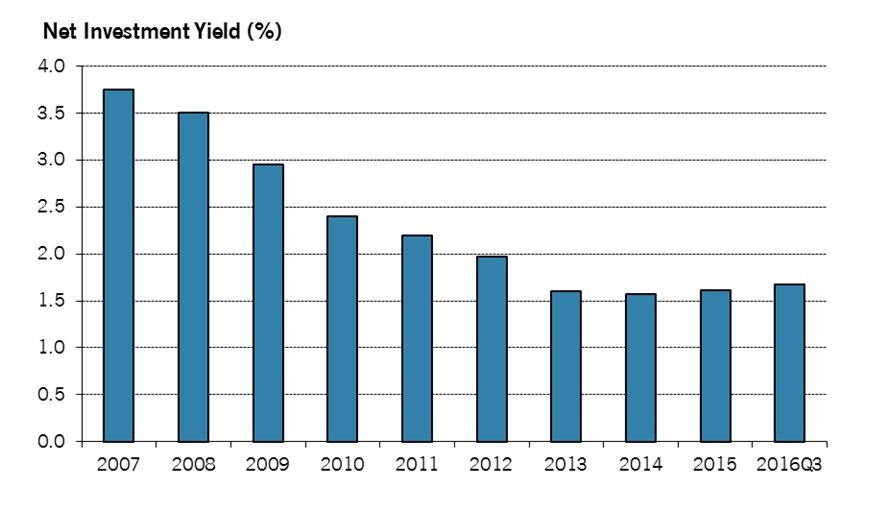

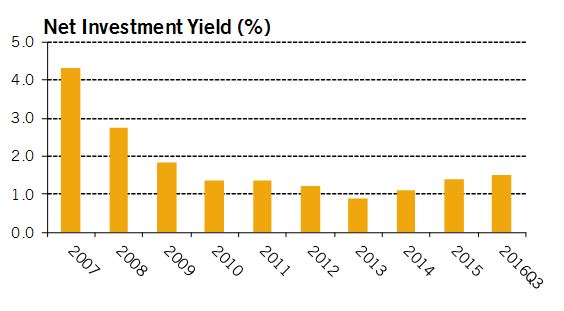

The average net yield on the CMP Aggregate’s investments increased marginally during 2016, though it remains little changed since 2013. The Aggregate’s bond portfolio remains well diversified across sectors and across the yield curve, with about 70% of bonds held maturing between 1-10yrs, suitable for a line of business that combines short-tail property claims and longer-tailed liability claims. Bond quality is strong, with a focus on NAIC 1 bonds plus a healthy 13% in NAIC 2 issues, with only minimal exposure to sub-IG issues (presumably due to downgrades rather than intentional high yield allocations, given the size of such positions). Approximately 25% of investment income comes from tax-exempt municipal bonds, in line with the broader industry and appropriate in the presence of ample underwriting income to offset AMT risk. Spreads on such bonds exploded higher after the election, and while they’ve reversed much of the move since then, the prospects for changes in corporate tax rates in 2017 suggest that more volatility lies ahead for this important investment sector.

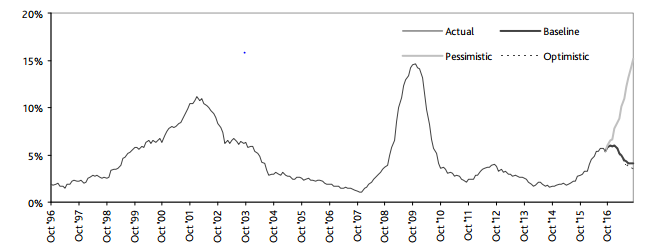

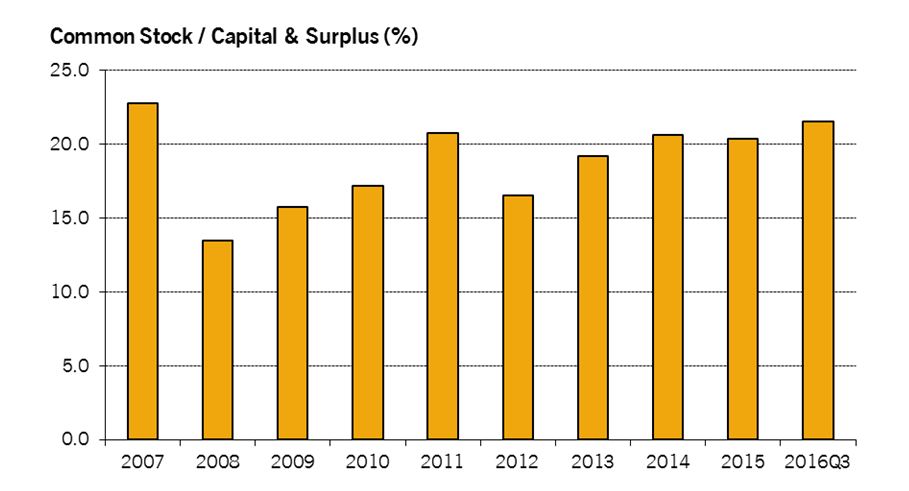

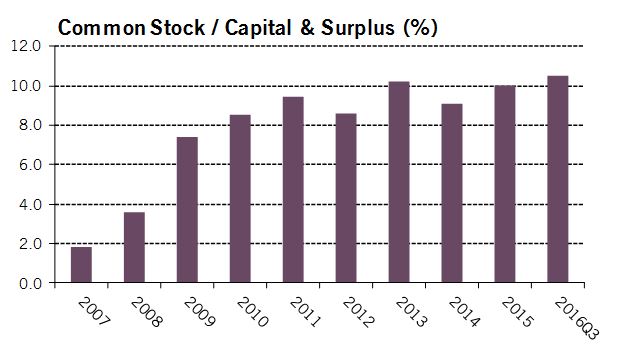

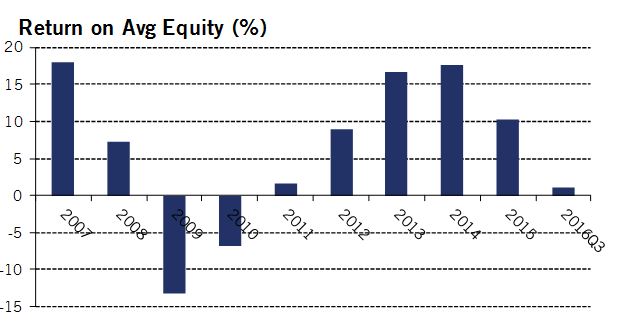

The CMP Aggregate’s exposure to unaffiliated common stock (measured as a % of surplus) grew from 20.4 to 21.6 in 2016, sustaining the creeping growth of recent years. After treading water for much of the year, equity markets rose significantly in Q4, suggesting that the year-end exposure will likely show further growth. As with the overall P&C industry, CMP insurer equity exposure is at the highest levels since before the financial crisis. While the strong performance of this market in the last 8 years has helped repair insurer balance sheets, the combination of high valuation measures and the rising interest rate environment may suggest that the low-hanging fruit has now been plucked. Insurers would be well advised to examine their equity allocations closely in coming months, and perhaps consider reducing risk through assets with downside protection like convertible bonds.

As entertaining as a review of financial statistics is, we’ll close by reviewing a few of the hot-button issues that have recently been impacting the P&C industry in general, and CMP insurers in particular.

- Cybersecurity remains a major issue, both with respect to insurers’ own internal security measures, and the rapidly growing demand for policies to protect against cyberattacks. These include a variety of coverages, including direct liability costs for privacy breaches, business disruption, reputational damage, and cost of restoring systems and mitigating customer loss. These and other coverages are increasingly being included with standard CMP policies, though for the time being the lack of actuarial data makes underwriting challenging. This also makes it a potentially attractive opportunity for insurers able to effectively assess and manage cyber risk and promote best practices among their insureds. In 2015 the NAIC begin collecting data on cybersecurity policies through a supplement to the annual statement, so over time it will become possible to track the growth and development of this sector.

- The growth of the “sharing economy” has created entire new markets for insurers, though the legal and regulatory status of these markets remains murky in many jurisdictions. For example, the rise of “ride-sharing” services like Uber and Lyft gave rise to accidents that were not covered by either the driver’s personal auto insurance (due to livery exclusions) or the limited coverage provided by Uber itself. This led to the creation of a new model law to promote policy designs that would enable such services to operate with comprehensive coverage. Comparable policies to cover rentals of private apartment space, office space, tools, and machinery could all potentially overlap with existing CMP product designs. As the line between personal and commercial property blurs, there is likely to be heated competition between these two halves of the insurance industry to capture the resulting opportunities.

- In 2017 AM Best plans to roll out a major overhaul to its Financial Strength Rating and Best’s Capital Adequacy Rating systems. Key changes will include the use of sophisticated dynamic financial modeling to determine required capital factors for a variety of balance sheet items, and the use of 5 BCAR scores corresponding to different statistical confidence intervals instead of the single score previously provided to rated companies. Scores will also be re-scaled so that a score greater than 0 corresponds to a surplus of required capital, and a negative score implies a deficit. Best has announced that they do expect significant ratings changes as a result of this new policy, and that the goal is greater transparency and utility rather than to correct any perceived inaccuracies in the current system.

AAM will continue to monitor important industry developments and provide timely updates, in keeping with our mission of providing customized and cutting-edge investment services to the insurance industry.

Note: All financial data sourced from SNL. AAM’s Commercial Multiple Peril Aggregate consists of 25 US insurers writing all or mostly CMP business for the past 5 calendar years.

Written by:

Peter Wirtala, CFA

Insurance Strategist

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Premium growth declined for the LTM period, coming in at just 4.5% after consistently posting double-digit growth for many years. Although start-up activity remains robust as Citizens continues to shed premium, competition has intensified and placed downward pressure on prices in some markets. Meanwhile, the aforementioned assignment-of-benefits controversy has had a chilling effect on impacted markets, as private insurers grow wary of opening themselves up to lawsuits from contractors for denial of claims. Citizens’ CEO Barry Gilway commented in a September interview with the Sun-Sentinel that “Markets are shutting down in South Florida. New business has no place to go but us (sic). It would not be a smart decision on the part of a CEO to pick up South Florida business until we’ve got legislative remedies for [assignment of benefits].”

Premium growth declined for the LTM period, coming in at just 4.5% after consistently posting double-digit growth for many years. Although start-up activity remains robust as Citizens continues to shed premium, competition has intensified and placed downward pressure on prices in some markets. Meanwhile, the aforementioned assignment-of-benefits controversy has had a chilling effect on impacted markets, as private insurers grow wary of opening themselves up to lawsuits from contractors for denial of claims. Citizens’ CEO Barry Gilway commented in a September interview with the Sun-Sentinel that “Markets are shutting down in South Florida. New business has no place to go but us (sic). It would not be a smart decision on the part of a CEO to pick up South Florida business until we’ve got legislative remedies for [assignment of benefits].”

Between unfavorable loss experience and the ongoing low level of investment yields, the FHA achieved a return on equity of just over 1% for the LTM period through 9/30/16. Additional underwriting losses in Q4 may push this figure below zero for the calendar year, though strong equity market returns may partially offset such losses. The period from 2012-2015 was very strong for this industry, thanks to modest storm activity and a booming stock market. Now it appears these tailwinds are fading, and challenges like the assignment-of-benefits controversy and increased pricing pressure from the influx of market entrants could mean a period of lean years lie ahead.

Between unfavorable loss experience and the ongoing low level of investment yields, the FHA achieved a return on equity of just over 1% for the LTM period through 9/30/16. Additional underwriting losses in Q4 may push this figure below zero for the calendar year, though strong equity market returns may partially offset such losses. The period from 2012-2015 was very strong for this industry, thanks to modest storm activity and a booming stock market. Now it appears these tailwinds are fading, and challenges like the assignment-of-benefits controversy and increased pricing pressure from the influx of market entrants could mean a period of lean years lie ahead.

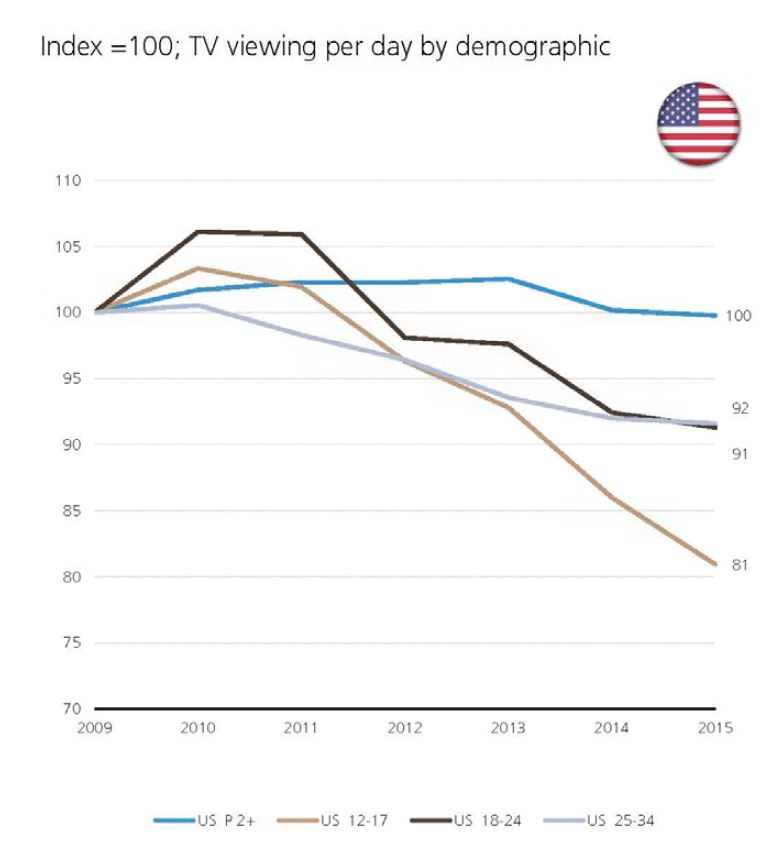

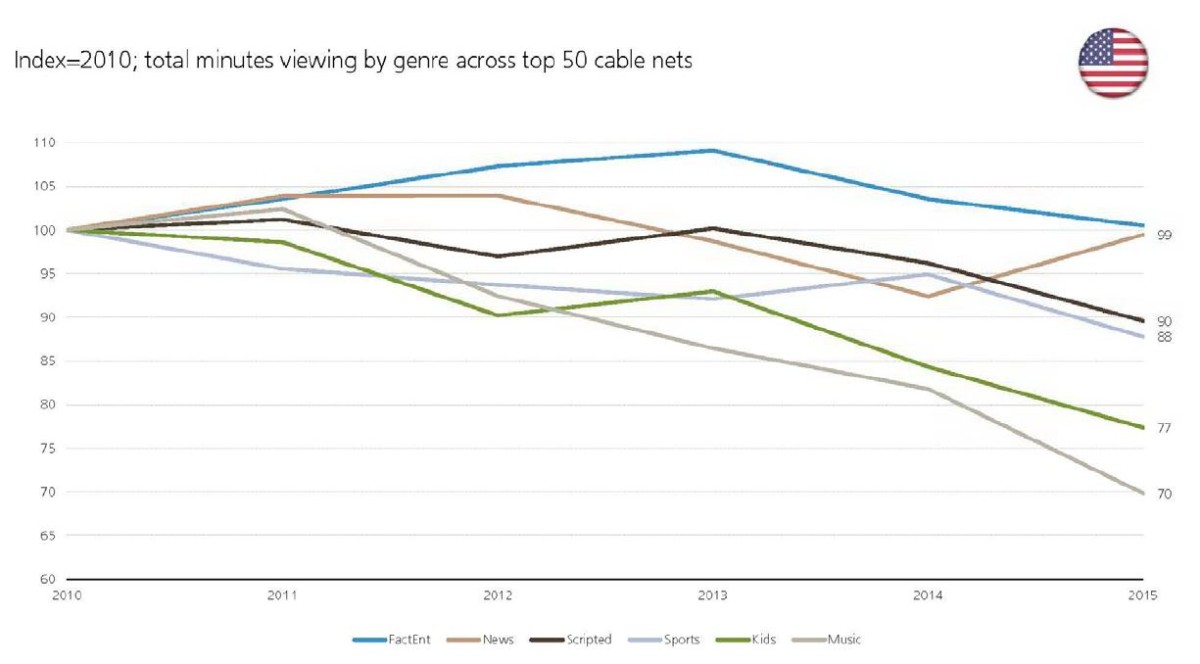

Source: UBS, Nielsen; Top 50 channels includes 12 factual entertainment networks (e.g., Discovery, History); 18 scripted networks (e.g., AMC, FX, USA, TBS); 7 kids networks (e.g., Nickelodeon, Disney Channel); 4 news networks; 3 sports networks; 2 music networks.

Source: UBS, Nielsen; Top 50 channels includes 12 factual entertainment networks (e.g., Discovery, History); 18 scripted networks (e.g., AMC, FX, USA, TBS); 7 kids networks (e.g., Nickelodeon, Disney Channel); 4 news networks; 3 sports networks; 2 music networks. Source: AAM

Source: AAM Source: Liberty Media

Source: Liberty Media