A long-term investment strategy will outshine cash in 2026

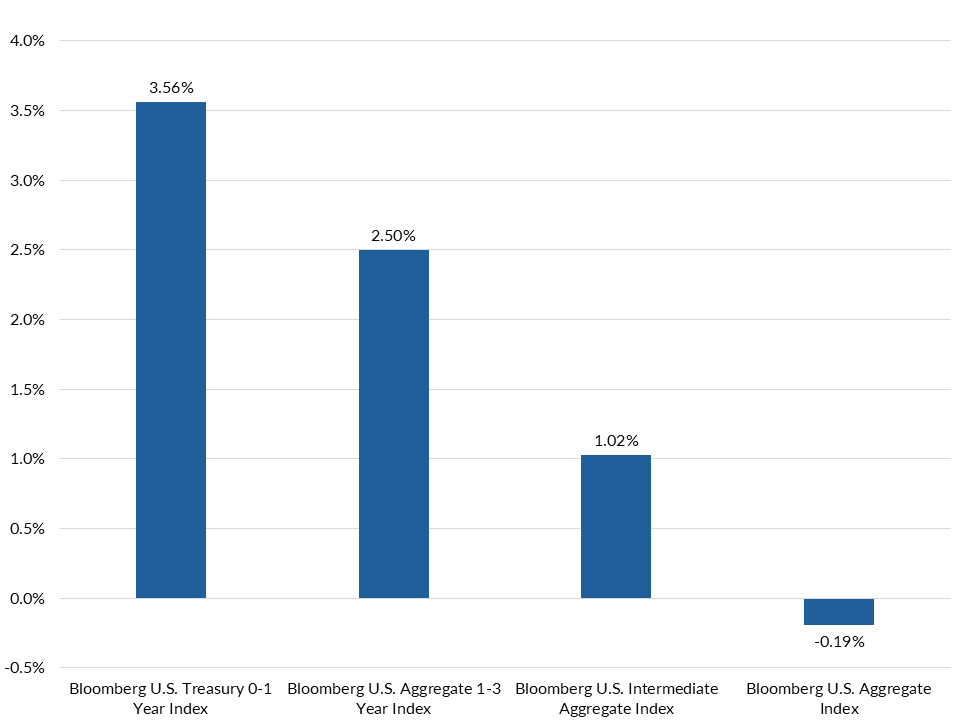

Following the Federal Reserve’s dramatic 2022 rate hiking cycle, short-term assets have enjoyed yields that have led to outperformance versus the remainder of the U.S. public investment-grade fixed income market. During that time, as rates rose, portfolios exposed to interest rate risk suffered negative total return. Cash sitting on the sidelines saw money market yields climb above 5%1 as the yield curve inverted. As if all of a sudden, a sleepy asset that was viewed as having a high opportunity cost, outshined the bond market.

Exhibit 1: Annualized Total Return 12/31/2021 – 10/31/2025

With the Fed’s easing cycle restarted, further reductions in the Federal Funds Rate are on the horizon. A liquidity sleeve is an important component for many investors. However, those with an outsized cash position should re-evaluate their investment strategy and ask “what’s next?”

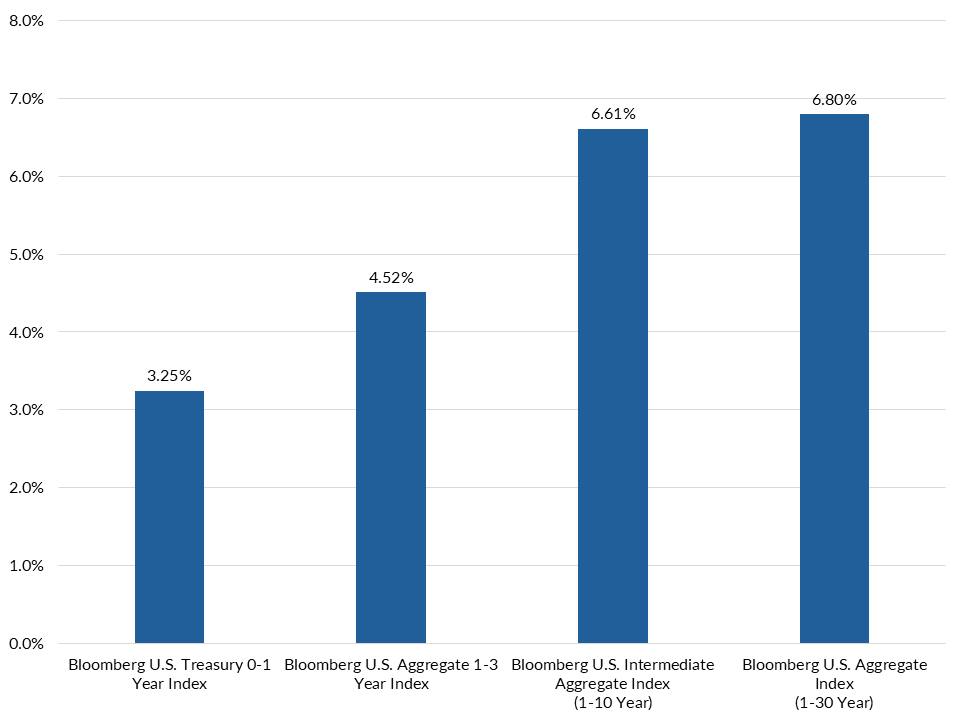

A mostly normalized yield curve has led investors to benefit from investing across maturities in 2025. While lower yields and tighter credit spreads have been a contributor, yields are higher for investors taking on duration risk. Bloomberg U.S. Aggregate indices across various tenors have handily outperformed short-term U.S. Treasuries (our proxy for cash) year-to-date. With the Fed expected to continue cutting rates, the yield differential between cash and invested assets should continue to magnify.

Exhibit 2: Total Return 12/31/2024 – 10/31/2025

Taking this analysis one step further, we can estimate expected return over the next 12 months if the Fed continues to cut rates. Considering various estimates, we make the assumption that three additional 25 basis point cuts occur between now and year-end 2026. We can utilize this projection to construct a scenario of rates over the next 12 months and estimate total return over that time period2.

Exhibit 3: Estimated 12-Month Total Return

Source: Federal Reserve, Bloomberg, ChatGPT

If the Fed continues to cut rates and the yield curve normalizes, cash is expected to underperform fixed income across tenors. In the unlikely scenario that we do not see any further rate cuts, cash may outperform short assets due to the existing curve inversion across intermediate tenors, but will lag longer investments.

In any event, for those investors holding onto excess cash, now is the time to determine a long-term investment strategy. Portfolios with an appropriate level of interest rate risk have been able to ride out this multi-year pendulum swing while maintaining a stable level of income. Cash flows invested prudently across the yield curve provide investors an opportunity to secure an income stream for longer than a few Fed meetings. It may have ruled for a while, but cash is no longer king.

1 The Federated Hermes Treasury Obligations Fund, a widely utilized cash sweep money market fund, saw its dividend yield surpass 5.3% in 2023.

2 The Three Rate Cuts scenario incorporates three 25 basis point reductions in the 10/31/2025 1-month US Treasury yield through 12/31/2026. 10-year U.S. Treasury and longer yields are unchanged, with the remainder of the curve normalizing towards an upward sloping curve between 1-month and 10-year tenors.