“Liberation Day,” the AI boom (or bubble), the Fed’s ongoing easing cycle, and the longest government shutdown in U.S. history — 2025 has been anything but quiet. Through all of that, the one constant holding up the U.S. economy has been the consumer. That said, conditions can change quickly, and as we look ahead to the holiday season, we expect solid but slightly below-trend growth of around 3%.

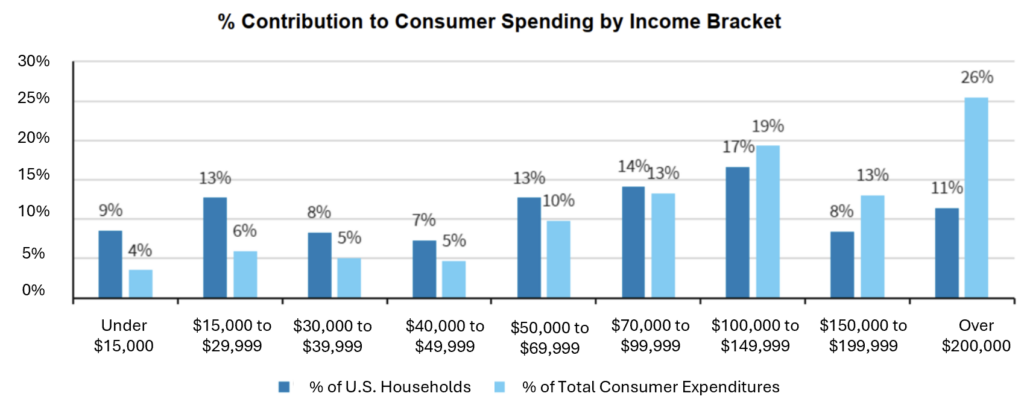

A good starting point for forecasting holiday spending is to have a clear read on the underlying economic health of the consumer. Even though some economic data releases are running behind, we believe the consumer remains on solid footing. Still, the backdrop has become more nuanced: job growth is slowing, inflation remains elevated, and the full impact of lower rates and upcoming tax benefits have yet to flow through. Crucially, the strength we’ve seen in recent spending continues to come from higher-income households, who have benefited from rising home values and investment gains. Please see the graph below with a focus on the $100,000 plus income brackets. This group makes up 36% of the population but drives 58% of total U.S. spending, underscoring how dependent overall demand has become on the upper tier.

We reviewed several comprehensive holiday surveys from Wall Street firms, including Citigroup and Morgan Stanley. Both asked consumers whether they planned to spend more, the same, or less than last year. To simplify the results, we calculated the year-to-year change in their “net” spending number (More – Less + Same). For Citigroup, the net figure fell from 29% last year to 24% this year. Morgan Stanley showed a slight improvement from 43% to 45%. Taken together, these responses suggest that the holiday consumer is slightly less optimistic overall, but not meaningfully weaker than last year.

Weather and the holiday calendar are also worth noting. They aren’t the biggest factors, but they can move the needle at the margin. Retailers benefit from cold but manageable weather — conditions that drive demand for winter apparel without reducing foot traffic. Last year, temperatures dropped sharply during the Black Friday weekend and stayed cold throughout December, which may create a tougher comparison if this season remains warmer for longer. On the calendar front, this year offers 26 shopping days between Black Friday and Christmas, compared to just 25 last year — the shortest possible window. The extra day won’t make or break the season but removes some of the compression pressure retailers faced in 2024.

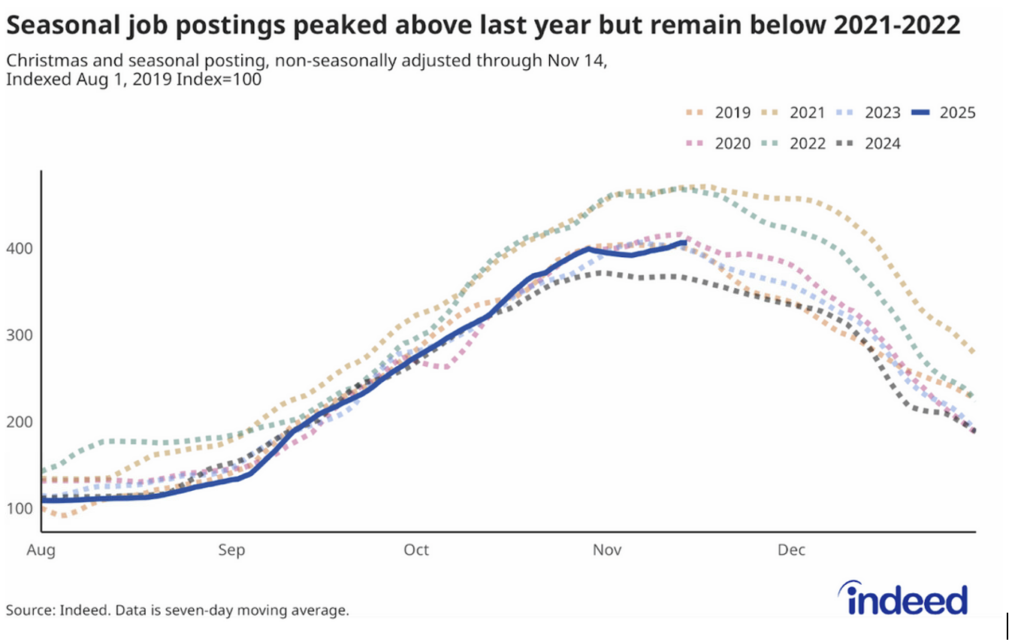

Some of the more interesting signals come from the labor market. Many investors view slowing job growth as an early warning sign for consumer spending. While we haven’t seen a clear deterioration yet, retailer hiring trends suggest a more cautious stance. The National Retail Federation expects 265,000 to 365,000 seasonal hires this year, down sharply from 442,000 last year. Challenger, Gray & Christmas expects seasonal hiring to fall about 8%, reaching its lowest level since 2009. Meanwhile, Indeed Hiring Lab data shows seasonal postings running about 11% above last year, but almost all of that increase is coming from logistics-related roles, not store-level hiring. See the graph below for a comparison of recent years seasonal job postings. This aligns with what we’ve been hearing from management teams throughout the year: a conservative, efficiency-driven approach to labor.

We also track one of our favorite leading indicators: the relationship between Back-to-School (BTS) spending in August and September and holiday sales in November and December. Over the last 20 years, the correlation between the two is roughly 85%. In 2024, BTS sales were up 3.4%, followed by a 4.1% increase in holiday sales. This year, BTS came in at 4.3%, which is a constructive signal for year-end spending.

Taken together, these factors frame our outlook for 2025. The typical holiday shopper appears to be in stable financial shape, with spending intentions that look broadly similar to last year — albeit slightly more restrained. The long-term average increase in holiday spending is around 4.2%, and last year finished at 4.1%. For 2025, we think the consumer takes a small breather, bringing growth down to around 3%.